Alexandria (ARE) Beats on Q1 FFO, Ups Adjusted FFO Mid-Point View

Alexandria Real Estate Equities, Inc. ARE reported first-quarter 2021 funds from operations (FFO) as adjusted of $1.91 per share, up 4.95% from the year-ago quarter’s $1.82. The figure also surpassed the Zacks Consensus Estimate of $1.85.

This year-over-year improvement resulted from the 9.1% year-over-year top-line improvement to $479.8 million. Results reflect decent internal and external growth. The company witnessed continued healthy leasing activity and rental rate growth during the quarter.

Moreover, the company has revised the 2021 outlook, raising the mid-point of its adjusted FFO per share guidance by 3 cents to $7.73.

In addition, management noted that its tenant collections have been consistently high, with 99.4% of April 2021 billings collected as of Apr 26, 2021. Also, as of Mar 31, 2021, the tenant receivables balance was $7.6 million.

Behind the Headline Numbers

Alexandria’s total leasing activity aggregated to 1.68 million rentable square feet (RSF) of space during the March-end quarter. Lease renewals and re-leasing of space amounted to 521,825 RSF.

On a year-over-year basis, same-property NOI was up 4.4%. It climbed 6.1% on a cash basis. Occupancy of operating properties in North America remained high at 94.5%. The company registered decent rental rate growth of 36.2% during the reported quarter. On a cash basis, rental rate increased 17.4%.

As of first-quarter 2021, investment-grade or publicly-traded large-cap tenants accounted for 55% of annual rental revenues in effect. Weighted-average remaining lease term of all tenants is 7.6 years. For the company’s top 20 tenants, it is 10.9 years.

During the January-March period, the company completed the acquisitions of 25 properties for a total of $1.9 billion. These acquisitions comprise 3.1 million SF space in key submarkets, including 1.8 million RSF from its acquisition of Alexandria Center®for Life

Science – Fenway. Particularly, the company acquired the Alexandria Center®for Life Science – Fenway, in the Fenway submarket, for $1.48 billion.

The company also kicked off the development and redevelopment of five projects, totaling 1.0 million RSF during the first quarter, which are currently 73% leased/negotiating.

Moreover, fully-leased development projects placed into service during the first quarter include 176,832 RSF leased to REGENXBIO Inc. at 9804 Medical Center Drive in the Rockville submarket, 100,086 RSF leased to Adaptive Biotechnologies Corporation at 1165 Eastlake Avenue East in the Lake Union submarket, and 99,557 RSF leased to Atreca, Inc. at the Alexandria Center® for Life Science – San Carlos in the Greater Stanford submarket.

Liquidity

Alexandria exited first-quarter 2021 with cash and cash equivalents of $492.2 million, down from the $568.5 million seen at the end of 2020. The company had $4.3 billion of liquidity as of the end of the reported quarter. Net debt and preferred stock to adjusted EBITDA was 5.8x and fixed-charge coverage ratio was 4.7x for first-quarter 2021 annualized.The company has no debt maturities prior to 2024 and its weighted-average remaining term of debt as of Mar 31, 2021 is 13 years.

Outlook

Alexandria also revised the 2021 outlook, guiding FFO per share in the range of $7.68-$7.78 compared with the $7.60-$7.80 estimated earlier, raising the mid-point by 3 cents to $7.73.The Zacks Consensus Estimate for the same is currently pinned at $7.73.

The company’s current-year guidance is backed by anticipations for occupancy in North America (as of Dec 31, 2021) in the band of 95.3-95.9% compared with the 95.6-96.2% guided earlier, rental rate increases for lease renewals, and re-leasing of space of 30-33% as against the prior guidance of 29-32%, and same-property NOI growth of 1.5-3.5% compared with the 1-3% guided earlier.

Alexandria currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

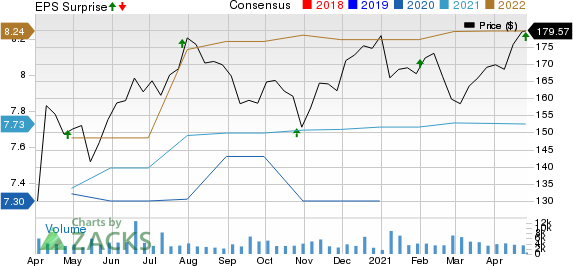

Alexandria Real Estate Equities, Inc. Price, Consensus and EPS Surprise

Alexandria Real Estate Equities, Inc. price-consensus-eps-surprise-chart | Alexandria Real Estate Equities, Inc. Quote

We now look forward to the earnings releases of other REITs like AvalonBay Communities AVB, Duke Realty DRE and Public Storage PSA scheduled for Apr 28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Duke Realty Corporation (DRE) : Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research