Alexandria's (ARE) Q4 FFO In Line, Rental Rates Rise Y/Y

Alexandria Real Estate Equities, Inc. ARE delivered first-quarter 2020 funds from operations (FFO) as adjusted of $1.82 per share, up 6.4% from the year-ago quarter’s $1.71. The reported figure came in line with the Zacks Consensus Estimate.

This year-over-year improvement resulted from top-line growth, which jumped 22.6% year over year to $439.9 million. The company witnessed continued strong leasing activity and rental rate growth during the quarter. It witnessed the highest quarterly rental rate growth over the past 10 years.

The company also revised its full-year outlook in the wake of the coronavirus pandemic and the prevailing market conditions.

It also apprised of its accounts receivable balance as of Apr 24, 2020 with 98.4% of April 2020 rent collected. Alexandria’s tenant receivables balance stands at $7.3 million, the lowest since 2012.

With the prevailing uncertain situation due to the coronavirus pandemic, the company has reduced its construction-spend forecast for 2020 from $1.6 billion to $960 million. The expected acquisitions for 2020 have also been reduced from $950 million to $650 million.

Behind the Headline Numbers

Alexandria’s total leasing activity aggregated to 703,355 rentable square feet (RSF) of space during the March-end quarter. Lease renewals and re-leasing of space amounted to 557,367 RSF.

On a year-over-year basis, same-property NOI was up 2.4%. It climbed 6.1% on a cash basis. Occupancy of operating properties in North America remained high at 97.5%. The company registered decent rental rate growth of 46.3% in the reported quarter, denoting the highest quarterly rental rate growth over the past decade. On a cash basis, rental rate increased 22.3%.

As of first-quarter 2020, investment-grade or publicly-traded large-cap tenants accounted for 51% of annual rental revenues in effect. Furthermore, 74% of the annual rental revenues are from Class A properties in AAA locations. Weighted-average remaining lease term of all tenants is 7.8 years. For its top 20 tenants, it is 11.4 years.

During the January-March period, the company completed acquisitions of eight properties for a total of $484.6 million. These acquisitions comprise 1.1 million RSF, including 106,021 RSF of current and future value-creation opportunities.

Liquidity

Alexandria exited first-quarter 2020 with cash and cash equivalents of $445.3 million, up from the $189.7 million reported at the end of the previous quarter. The company had $4 billion of liquidity as of the end of the first quarter. Also, it has zero debt maturing until 2023.

Guidance

In light of the coronavirus pandemic and the choppy market conditions, the company has revised its FFO per share guidance to $7.25-$7.35 from $7.28-$7.48. The Zacks Consensus Estimate for the same is currently pegged at $7.15.

The revision is based on a reduction of eight cents in projected revenues from its retail tenancy and transient/short-term parking business, higher interest costs and updated timing of deliveries, offset by an improvement in EBITDA from its core operations.

The company also anticipates a reduction in its projected remaining required sources of capital.

The company’s current-year guidance is backed by expectations for occupancy in North America (as of Apr 27, 2020) in the band of 94.8-95.4%, rental rate increases for lease renewals, and re-leasing of space of 28-31%, and same-property NOI growth of 1-3%.

Alexandria currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

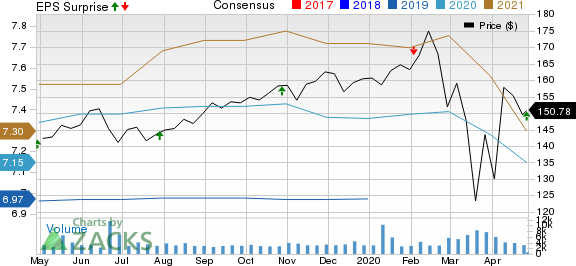

Alexandria Real Estate Equities, Inc. Price, Consensus and EPS Surprise

Alexandria Real Estate Equities, Inc. price-consensus-eps-surprise-chart | Alexandria Real Estate Equities, Inc. Quote

We now look forward to the earnings releases of other REITs like Duke Realty Corporation DRE, Public Storage PSA and Realty Income Corporation O, slated to release first-quarter results on Apr 29, Apr 30 and May 4, respectively.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Duke Realty Corporation (DRE) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research