Alexco Resource (TSE:AXU) Shareholders Have Enjoyed An Impressive 244% Share Price Gain

Alexco Resource Corp. (TSE:AXU) shareholders might be concerned after seeing the share price drop 12% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 244% the gain in that time. To some, the recent pullback wouldn't be surprising after such a fast rise. Ultimately business performance will determine whether the stock price continues the positive long term trend.

See our latest analysis for Alexco Resource

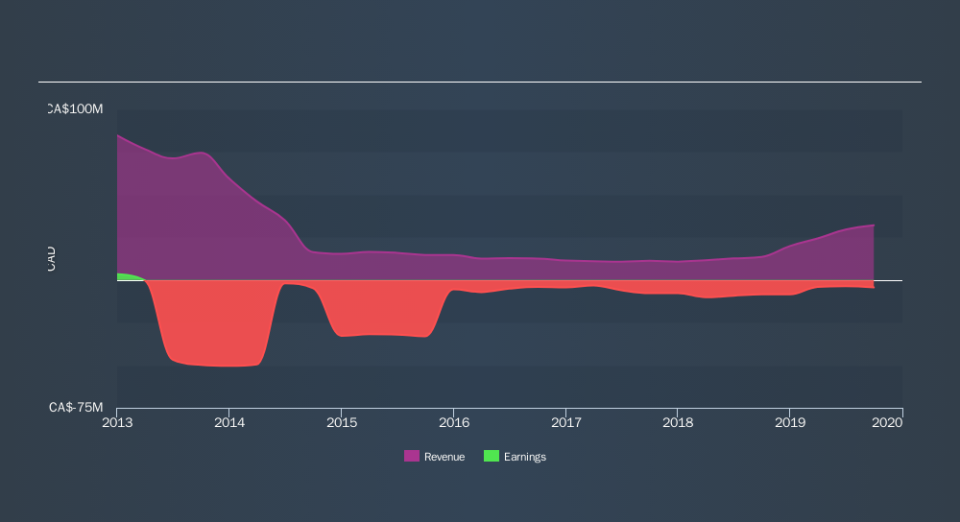

Given that Alexco Resource didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Alexco Resource can boast revenue growth at a rate of 11% per year. That's a pretty good long term growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 28% per year over five years. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Alexco Resource's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Alexco Resource shareholders have received a total shareholder return of 123% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 28% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on Alexco Resource it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.