Alibaba Acquires Kaola for $2B, Expands E-Commerce Business

Alibaba Group Holding Limited BABA is focused on bolstering presence in the e-commerce market. The company has bought an import e-commerce business, Kaola, from NetEase for about $2 billion.

Alibaba plans to operate Kaola as an independent business. Alvin Liu, the general manager of Alibaba’s Tmall business, will serve as Kaola's new CEO.

Launched in 2015, NetEase Kaola sells household appliances and other commodities including apparel, maternity products, and infant and personal care items.

In addition to the Kaola acquisition, Alibaba has agreed to invest approximately $700 million in NetEase Cloud Music. The completion of this transaction is subject to certain closing conditions. Following the closure of the deal, NetEase will continue to remain the controlling shareholder of NetEase Cloud Music.

With this buyout, Alibaba aims at further expanding foothold in the Chinese e-commerce market and make the most of the world’s second-largest economy.

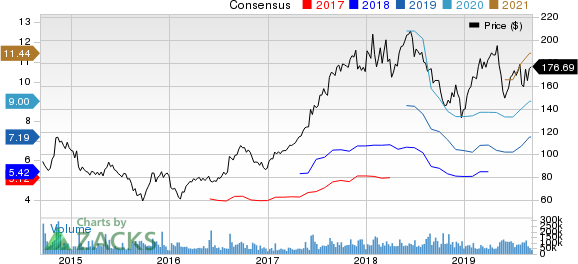

Alibaba Group Holding Limited Price and Consensus

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

Deal Rationale

This transaction will represent further consolidation in China’s e-commerce sector.

NetEase Kaola, which is considered to be the biggest Chinese shopping site, has always been an archrival of Alibaba’s Tmall Global. According to iiMedia Research Group’s research report, NetEase Kaola held a 27.5% market share in cross-border e-commerce in 2018, while Tmall Global accounted for 25%.

Therefore, the said acquisition will definitely reduce Alibaba’s competition, making it the biggest shopping site in China.

Notably, the online retail market of China is witnessing a boom on account of increasing penetration of internet and mobile use. Per a report from Forrester, the country’s online retail market is anticipated to reach $1.8 trillion by 2022. Further, sales in this market are expected to witness a CAGR of 8.5% between 2018 and 2022.

In addition, an eMarketer’s report shows that China is anticipated to contribute 56% to global online retail sales in 2019. Moreover, China’s contribution is expected to cross 63% by 2022.

Therefore, we believe, with the latest acquisition, Alibaba will be able to drive the top line and profit generation in the future.

In the recently reported quarter, its core commerce segment — which comprises marketplaces operating in retail and wholesale commerce in China, and international commerce — performed well. The segment’s revenues in the quarter totaled RMB99.5 billion (US$14.5 billion), reflecting an increase of 44% on a year-over-year basis.

Bottom Line

The e-commerce sector continues to grow, driven by rapid proliferation of smartphones and internet on a global basis. Notably, these two factors are strengthening online retail shopping, in turn bolstering the adoption rate of online payment solutions and driving e-commerce growth.

Additionally, emerging markets like China, India and most importantly Latin American economies are witnessing rapid adoption of e-commerce technology.

Markedly, Alibaba is now the principal e-commerce retailer in China on a scale with Amazon (AMZN), dominating 58% of the total e-commerce market in the country, according to eMarketer.

In the last reported quarter, Alibaba’s annual active consumers on retail marketplaces reached 674 million, which marked a 20-million increase from the 12-month period ended in the March quarter. Also, mobile MAUs on China retail marketplaces reached 755 million in June 2019, reflecting a 34-million increase from March 2019.

Notably, Amazon has been trying hard to expand exposure in China’s online retail space with different strategic moves. Expanding seller base, distribution strength, strategic acquisitions and partnerships are helping it expand e-commerce share in China.

Nevertheless, Alibaba’s e-commerce business has significant growth opportunities, driven by robust product portfolio, strengthening IoT capabilities and key offerings. Given the growing position of the business in China and aggressive international expansion strategies, we believe that e-commerce will be one of its major growth drivers in the long run.

Zacks Rank and Other Stocks to Consider

Alibaba currently carries a Zacks Rank #1 (Strong Buy).Other top-ranked stocks in the broader technology sector include Alphabet Inc. GOOGL, Itron, Inc. ITRI and MACOM Technology Solutions Holdings, Inc. MTSI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Alphabet, Itron and MACOM Technology is currently projected at 17.5%, 25% and 15%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.