Alibaba's Cloud Potential

Alibaba Group Holding Ltd. (NYSE:BABA) has lost significant value since 2021 due to Covid-19 disruptions, the regulatory tech crackdown and macro adversities.

Still, the Chinese company has long-term growth potential based on rising demand and transformative strategies. During this turbulence, its cloud segment has emerged as a trailblazer in the cloud computing industry. With a sharp focus on capitalizing on cloud and artificial intelligence opportunities, the company has positioned itself for rapid growth.

The potency of Alibaba cloud

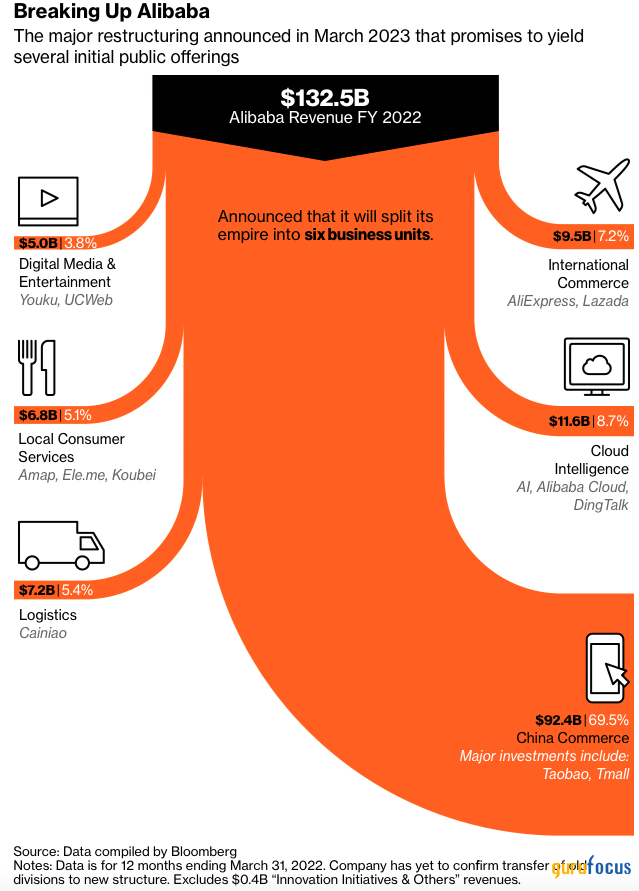

With plans to split into six separate companies, Alibaba's cloud business especially remains a critical bullish catalyst as it sharpens its core e-commerce focus while unlocking immense value for shareholders. Agility, synergies and capital returns are just the beginning of the company's long-term value creation. Thus, shareholders will reap the benefits of the spun off cloud segment through stock dividends, which continue to grow and maintains favorable long-term fundamentals.

Alibaba Cloud is strategically positioning itself to capitalize on the rising demand for cloud services and the increasing applications of artificial intelligence. The goal is for the Cloud Intelligence Group to become an independent, publicly listed company, enabling it to enhance its business strategy, optimize operations and streamline its organization. This spinoff involves distributing stock dividends to shareholders and include external strategic investors through private financing.

The cloud computing industry has witnessed a surge in demand driven by industrial digitalization and the broader adoption of AI. Alibaba Cloud aims to leverage these opportunities to maximize its market potential. With its established leadership in China and around the world, the business aims to provide stable, secure, high-performance and cost-effective computing services. In addition, the company believes it is well positioned to support the training and benefits of extensive AI and vertical models in the market.

The resurgence of the pandemic in China and delays in specific hybrid cloud projects affected public cloud consumption. The decreased demand for services such as content delivery networks was observed as remote working and school activities declined. Despite these short-term fluctuations, Alibaba Cloud maintains confidence in the immense market potential and long-term growth of the cloud industry, particularly with the rapid development of AI.

To capitalize on AI opportunities, Alibaba Cloud will focus on two key areas. First, it aims to provide a stable and efficient computing infrastructure to support its self-developed foundational models as well as other large and vertical models. These include collaborating with enterprise customers and entrepreneurs to meet their training and service requirements.

Second, Alibaba Cloud is building its model as a service platform on top of its foundation models. The company plans to offer its proprietary foundation models to the public while supporting customers, partners and developers in creating vertical models and services based on these foundations. For example, Alibaba Cloud has already released a popular large-language, pre-trained model called Tongyi Qianwen, which has generated significant interest with over 200,000 trial access applications. The company aims to develop more products and enterprise solutions based on the Tongyi model.

Source: Bloomberg

Alibaba Cloud's pricing strategy focuses on making computing power more accessible, particularly to small and medium-sized enterprises, developers and university students. Through these initiatives, Alibaba Cloud aims to cultivate future demand as these entities grow. In addition, the company leverages its market leadership to pass on the benefits of its technological advantages and achieve substantial economies of scale.

While facing competition from new entrants, Alibaba Cloud maintains a significantly higher proportion of public cloud revenue than its competitors. The company concentrates on growing high-quality revenue from its core infrastructure products and software as a service. It concentrates on providing value to customers by leveraging its economies of scale.

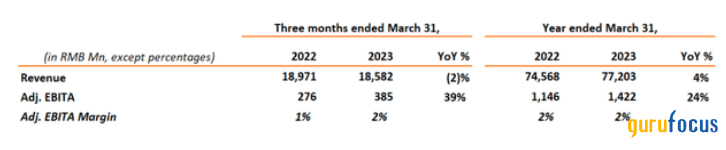

Alibaba Cloud noticed a decline in cloud sector revenue during the fourth quarter of 2023. The total revenue from the cloud segment reached $3.58 billion before inter-segment reduction, representing a 3% year-over-year decline. Sales reached $2.71 billion after inter-segment elimination, a 2% year-over-year decline.

Although profitability still lags behind other leading international cloud ventures, Alibaba Cloud continues to scale and achieve more significant economies of scale, especially in core technology development. Further, it is confident in its ability to increase profitability. More specifically, the segment's adjusted Ebita has significantly improved by 39% year over year for the fourth quarter of 2023 and 24% year over year for fiscal 2023. As a result, the cloud segment achieved an adjusted Ebita profit of 385 million yuan ($54.52 million), representing a year-over-year increase of 109 million yuan. Finally, despite the decline in revenue, the segment improved profitability through effective cost management and optimization strategies.

Source: Earnings presentation

What the technical charts suggest about the stock

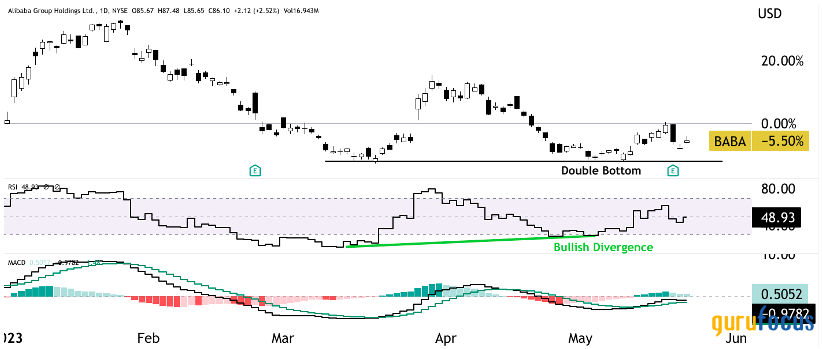

Alibaba has generated a negative return of over 5% so far in 2023. In May, the stock formed a double bottom while creating a bullish divergence on the relative strength index, with the moving average convergence/divergence line crossing above the signal line, signifying an emerging bullish momentum.

Although the execution of the spinoff is 12 months away, the efficient market has started to integrate the impact of these developments into the price.

Source: TradingView.com

Takeaway

In conclusion, Alibaba's positioning in the cloud computing industry and its strategic initiatives demonstrate its commitment to capitalizing on the growing demand for cloud services and AI applications. While the company faced challenges in the last quarter, it remains confident in the long-term growth potential of the cloud industry.

The spinoff of the Cloud Intelligence Group and the distribution of stock dividends offer benefits such as strategic focus, value unlocking, agility and capital returns to shareholders. By leveraging synergies, pursuing growth opportunities and maintaining collaboration, Alibaba aims to drive innovation and maximize shareholder value in its core e-commerce businesses and cloud computing endeavors.

This article first appeared on GuruFocus.