Alimera (ALIM) Up on Deal With Eyepoint for U.S. Rights to Yutiq

Alimera Sciences ALIM announced acquiring additional U.S. commercialization rights for 0.18 mg dose strength of Yutiq from EyePoint Pharmaceuticals, Inc. Yutiq is indicated to treat chronic non-infectious uveitis affecting the posterior segment of the eye.

Per the terms of the agreement, Alimera made an upfront cash payment of $75 million to Eyepoint, upon closing the deal, along with an additional $7.5 million, to be paid in equal quarterly installments in 2024. Eyepoint is also eligible to receive tiered royalty payments from Alimera, beginning 2025 to 2028 based on combined net revenues in the United States from Iluvien and Yutiq. The payment of these potential royalties is subject to certain thresholds, beginning at $70 million in 2025 and increasing annually thereafter.

Shares of Alimera rallied 19.4% on Thursday, following the positive news. In the past year, shares of Alimera have plunged 50.9% compared with the industry’s 6.8% decline.

Image Source: Zacks Investment Research

Alimera’s Iluvien received FDA approval in September 2014 for the treatment of diabetic macular edema (DME) in patients who have been previously treated with a course of corticosteroids and did not have a clinically significant rise in intraocular pressure.

Currently, Iluvien is the only FDA-approved product in Alimera’s portfolio. Iluvien is an anti-vascular endothelial growth factor (anti-VEGF) therapy to treat DME in the United States and outside the United States for non-infectious uveitis affecting the posterior segment of the eye. The company is currently conducting a NEW DAY clinical study, evaluating Iluvien’s efficacy as baseline therapy in patients with early DME by comparing Iluvien with current standard-of-care, anti-VEGF therapy.

Alimera is set to immediately take over the reins of all commercial activities related to Yutiq in the United States. However, Alimera’s global rights to Yutiq exclude China, Hong Kong, Taiwan, Macau, South Korea and Southeast Asia, where Eyepoint has a pre-existing license with Ocumension Therapeutics.

Management believes that the acquisition of U.S. rights to Yutiq is a landmark deal as the revenue flow is expected to increase substantially on the back of commercial infrastructure to market Iluvien in the United States.

Yutiq is expected to highly complement Iluvien and be accretive to revenues, adjusted EBITDA and cash flow in the second half of 2023. Alimera further states that a larger commercial team focused on marketing the two drugs will increase efficiency in the utilization of resources. It expects more than $100 million in net revenues and $20 million in adjusted EBITDA in 2024.

Per reports from Eyepoint, Yutiq is already gaining traction in the market with $7.4 million in first-quarter 2023 in sales. For 2022, Yutiq sales increased 67% to $28.3 million from 2021.

Current standard-of-care anti-VEGF therapies are marketed by big companies like Regeneron REGN, Novartis NVS and Roche RHHBY, which have commercially approved products for the treatment of retinal diseases like wet-age-related macular degeneration (wet AMD), DME and retinal vein occlusion (RVO).

Regeneron’s Eylea is a leader in the treatment of wet AMD, DME and macular edema following RVO, which includes macular edema following central RVO and macular edema following branch RVO. The FDA also recently approved Eylea to treat preterm infants with retinopathy of prematurity.

Novartis’ Beovu is approved for the treatment of wet AMD. It is also currently approved in the European Union (EU) for the same indication.

Last January, Roche’s Vabysmo was also approved by the FDA for the treatment of wet AMD and DME. Roche received approval for Vabysmo in the EU for the same indication in September 2022.

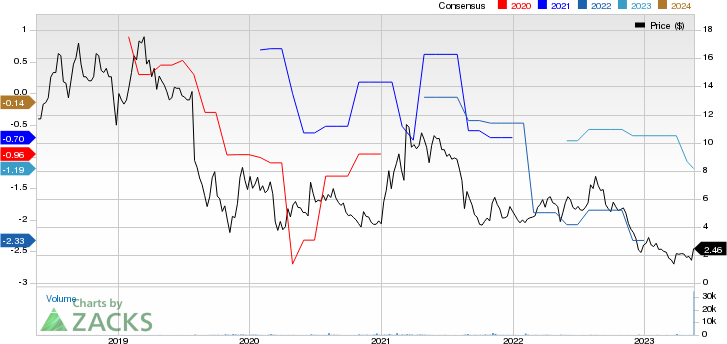

Alimera Sciences, Inc. Price and Consensus

Alimera Sciences, Inc. price-consensus-chart | Alimera Sciences, Inc. Quote

Zacks Ranks

Alimera currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Alimera Sciences, Inc. (ALIM) : Free Stock Analysis Report