Are ALJ Regional Holdings Inc’s (NASDAQ:ALJJ) Interest Costs Too High?

Investors are always looking for growth in small-cap stocks like ALJ Regional Holdings Inc (NASDAQ:ALJJ), with a market cap of US$87.22M. However, an important fact which most ignore is: how financially healthy is the business? IT companies, even ones that are profitable, tend to be high risk. So, understanding the company’s financial health becomes essential. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. Though, given that I have not delve into the company-specifics, I’d encourage you to dig deeper yourself into ALJJ here.

Does ALJJ generate an acceptable amount of cash through operations?

Over the past year, ALJJ has maintained its debt levels at around US$101.18M – this includes both the current and long-term debt. At this current level of debt, the current cash and short-term investment levels stands at US$5.63M , ready to deploy into the business. Additionally, ALJJ has generated US$25.23M in operating cash flow in the last twelve months, resulting in an operating cash to total debt ratio of 24.94%, indicating that ALJJ’s current level of operating cash is high enough to cover debt. This ratio can also be a sign of operational efficiency as an alternative to return on assets. In ALJJ’s case, it is able to generate 0.25x cash from its debt capital.

Can ALJJ meet its short-term obligations with the cash in hand?

With current liabilities at US$49.71M, it appears that the company has been able to meet these obligations given the level of current assets of US$70.25M, with a current ratio of 1.41x. Generally, for IT companies, this is a reasonable ratio since there’s sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Is ALJJ’s debt level acceptable?

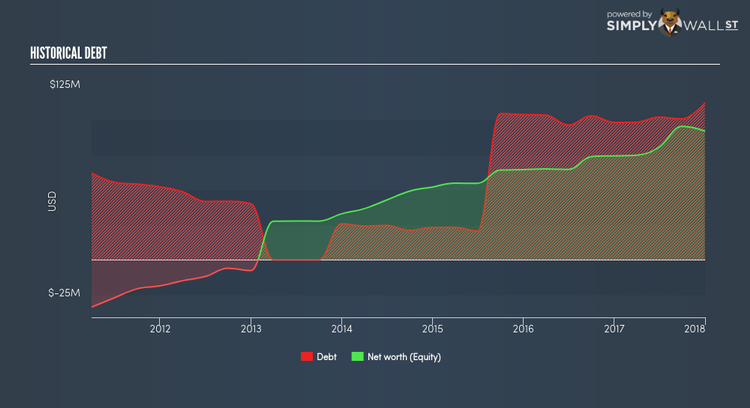

With total debt exceeding equities, ALJJ is considered a highly levered company. This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. We can check to see whether ALJJ is able to meet its debt obligations by looking at the net interest coverage ratio. A company generating earnings before interest and tax (EBIT) at least three times its net interest payments is considered financially sound. In ALJJ’s, case, the ratio of 1.14x suggests that interest is not strongly covered, which means that debtors may be less inclined to loan the company more money, reducing its headroom for growth through debt.

Next Steps:

At its current level of cash flow coverage, ALJJ has room for improvement to better cushion for events which may require debt repayment. Though, the company will be able to pay all of its upcoming liabilities from its current short-term assets. I admit this is a fairly basic analysis for ALJJ’s financial health. Other important fundamentals need to be considered alongside. I recommend you continue to research ALJ Regional Holdings to get a better picture of the stock by looking at the areas below. Just a heads up – to access some parts of the Simply Wall St research tool you might be asked to create a free account, but it takes just one click and the information they provide is definitely worth it in my opinion.

1. Valuation: What is ALJJ worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in this free research report helps visualize whether ALJJ is currently mispriced by the market.

2. Historical Performance: What has ALJJ’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of ALJJ’s historicals for more clarity.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore a free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.