Alkermes' (ALKS) Q4 Earnings and Revenues Beat Estimates

Alkermes plc ALKS reported fourth-quarter 2021 adjusted earnings of 23 cents per share, which beat the Zacks Consensus Estimate of 13 cents. The company reported adjusted earnings of 10 cents per share in the year-ago quarter.

The company’s revenues of $324.5 million increased 15.9% from the year-ago quarter. The top line, also surpassed the Zacks Consensus Estimate of $320 million.

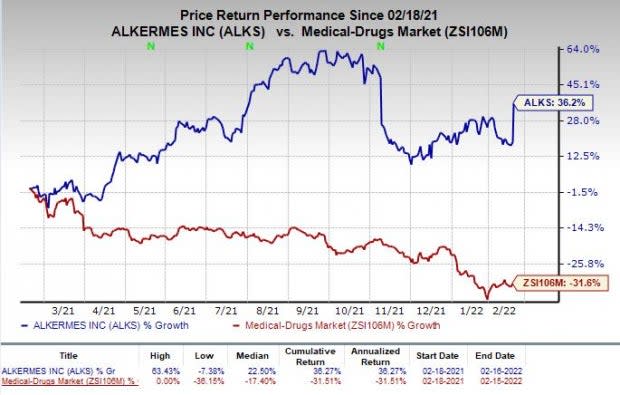

Shares of Alkermes were up 14.9% on Wednesday owing to the better-than-expected fourth-quarter results. The stock has rallied 36.2% in the past year against the industry’s decline of 31.6%.

Image Source: Zacks Investment Research

Full-Year Results

For 2021, Alkermes generated total revenues of $1.17 billion compared with $1.04 billion recorded in 2020.

For full-year 2021, the company reported adjusted earnings of 78 cents per share compared with 43 cents per share in 2020.

Quarter in Detail

Total manufacturing and royalty revenues were up 9.5% year over year to $143.4 million, primarily driven by growth in Vumerity. Vumerity revenues increased around 73% to $26.9 million.

Sales of proprietary drug Vivitrol (for alcohol and opioid dependence) increased approximately 15% year over year to $92 million, while the same for Aristada (for schizophrenia) increased approximately 14.1% year over year to $78.7 million. These increases were driven by the underlying unit growth.

Research and development (R&D) expenses were $98.4 million, down 12.2% year over year.

Selling, general and administrative (SG&A) expenses were $160.4 million, up 10% year over year due to increased investment to support the launch of Lybalvi (olanzapine and samidorphan).

Newly approved medicine, Lybalvi, generated sales worth $8.2 million following its launch in October 2021. In June 2021, the FDA approved Lybalvi for the treatment of adults suffering from schizophrenia or bipolar I disorder.

As of Dec 31, 2021, Alkermes had cash and cash equivalents worth $765.7 million compared with $748.2 million on Sep 30, 2021. Total outstanding debt was $295.8 million as of Dec 31, 2021.

2022 Guidance

Alkerm esexpects total revenues in the range of $1.0 billion to $1.09 billion in 2022. The Zacks Consensus Estimate for revenues stands at $1.24 billion.

Vivitrol net sales are expected between $355–$385 million and Aristada net sales are expected between $290–$320 million. Lybalvi net sales are expected between $55–$75 million.

Pipeline Updates

Earlier this month, Alkermes announced positive top-line data from the phase IIIb ENLIGHTEN-Early study, which evaluated the effect of Lybalvi versus olanzapine on body weight in patients aged between 16 to 39 with schizophrenia, schizophreniform disorder or bipolar I disorder who were early into their illness.

Data from the same showed that treatment with Lybalvi demonstrated less weight gain compared to olanzapine in the given patient population. The study met its pre-specified primary endpoint.

Alkermes is conducting the phase III ARTISTRY-7 study, which is evaluating the anti-tumor activity and safety of its pipeline candidate, nemvaleukin alfa, in combination with Merck’s MRK Keytruda (pembrolizumab), an anti-PD-1 antibody, for treating patients with platinum-resistant ovarian cancer.

Merck’s biggest revenue generator, Keytruda, is approved for treating several types of cancer indications. Merck is also studying Keytruda for addressing yet more cancer indications.

Alkermes dosed the first subject in a phase I study evaluating the safety and tolerability of ALKS 1140 in healthy adults in November 2021. The candidate is being developed for the treatment of neurodegenerative and neurodevelopmental disorders.

Alkermes plc Price, Consensus and EPS Surprise

Alkermes plc price-consensus-eps-surprise-chart | Alkermes plc Quote

Zacks Rank & Stocks to Consider

Alkermes currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include Axsome Therapeutics, Inc. AXSM and Kaleido Biosciences, Inc. KLDO, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axsome Therapeutics’ loss per share estimates have narrowed 0.5% for 2022 over the past 60 days.

Earnings of Axsome Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Kaleido Biosciences’ loss per share estimates have narrowed 11.3% for 2022 over the past 60 days.

Earnings of Kaleido Biosciences have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report

Kaleido Biosciences, Inc. (KLDO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research