Allegheny (ATI) Beats Earnings and Sales Estimates in Q4

Allegheny Technologies Incorporated ATI slipped to a net loss of $1,121 million or $8.85 per share in fourth-quarter 2020 from net income of $56.5 million or 41 cents per share in the prior-year quarter.

Excluding one-time items, adjusted loss per share was 33 cents, narrower than the Zacks Consensus Estimate of a loss of 37 cents.

The company delivered revenues of $658.3 million in the quarter, down 35.4% year over year. Nevertheless, the figure surpassed the Zacks Consensus Estimate of $589.5 million.

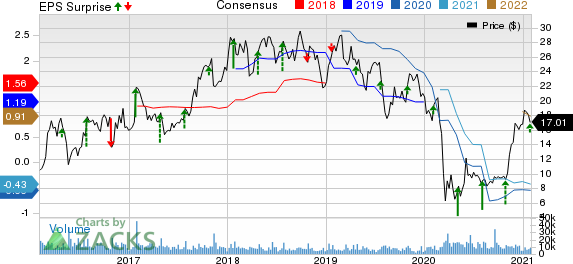

Allegheny Technologies Incorporated Price, Consensus and EPS Surprise

Allegheny Technologies Incorporated price-consensus-eps-surprise-chart | Allegheny Technologies Incorporated Quote

Segment Highlights

In the fourth quarter, revenues in the High-Performance Materials & Components (“HPMC”) segment declined 55% year over year to $222.3 million. The company stated that 74% of unit sales were attributable to the aerospace and defense markets. EBITDA in the unit was $7.5 million against $92.9 million in the prior-year quarter. Reduced asset utilization rates and lower overall demand affected operating margins.

The Advanced Alloys & Solutions (“AA&S”) segment’s sales fell 16% year over year to $436 million. Total sales to all energy markets declined 18% year over year. EBITDA in the division totalled $29.5 million compared with $48 million in the prior-year quarter. Improved sales of high-value products at Specialty Alloys & Components business and the STAL joint venture and cost reduction had a positive impact on EBITDA.

FY20 Results

Loss (as reported) for full-year 2020 was $12.43 per share against earnings of $1.85 per share a year ago. Net sales fell 27.7% year over year to roughly $2.98 billion.

Financial Position

Allegheny ended the year with cash and cash equivalents of $645.9 million, up 31.6% year over year. Long-term debt increased 11.7% year over year at $1,550 million.

Cash provided by operating activities for the fourth quarter of 2020 was $121.9 million.

Outlook

Allegheny expects first-quarter of 2021 results to be affected by the resurgence of coronavirus cases and low global air passenger travel. For 2021, it anticipates demand to start rebound with the approval and administration of vaccines around the world.

The company is expecting an improvement in demand in second half of 2021 owing to rising narrow-body engine production volumes, jet engine-related share gains and new business in airframes. It is focused on delivering the best to its customers, transform its specialty rolled business as well as sustain strength of its balance sheet and cash-generation efforts.

Price Performance

Shares of Allegheny have dropped 0.5% in the past year compared with 11.2% decline of the industry.

Zacks Rank & Key Picks

Allegheny currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, BHP Group BHP and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of 75.5% for the current fiscal. The company’s shares have surged around 125.9% in a year. It currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BHP has an expected earnings growth rate of 59.5% for the current fiscal. The company’s shares have gained around 31.5% in the past year. It currently flaunts a Zacks Rank #1.

Impala has an expected earnings growth rate of 189.4% for the current fiscal. The company’s shares have rallied around 42.3% in the past year. It currently sports a Zacks Rank #1.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research