Allegheny (ATI) Earnings and Revenues Beat Estimates in Q3

Allegheny Technologies Incorporated ATI recorded net profit of $48.7 million or 35 cents per share in third-quarter 2021 versus a loss of $50.1 million or 40 cents per share in the prior-year quarter.

Barring one-time items, adjusted earnings were 5 cents per share, which beat the Zacks Consensus Estimate of a loss of 3 cents.

The company delivered revenues of $725.7 million in the quarter, up 21.3% year over year. The figure surpassed the Zacks Consensus Estimate of $677.6 million.

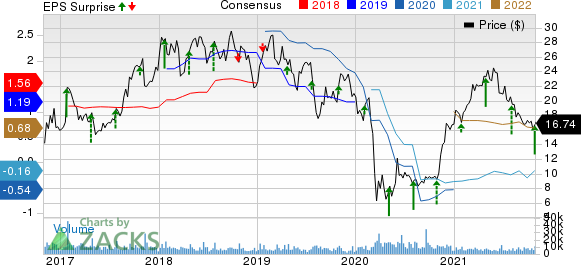

Allegheny Technologies Incorporated Price, Consensus and EPS Surprise

Allegheny Technologies Incorporated price-consensus-eps-surprise-chart | Allegheny Technologies Incorporated Quote

Segment Highlights

In the third quarter, revenues in the High-Performance Materials & Components (“HPMC”) segment totaled $300 million, up 35.6% year over year. The sales figure reflected higher commercial jet engine and energy markets sales. EBITDA in the unit was $37.4 million compared with $16.8 million in the prior-year quarter. Higher production volumes, share gains and cost-cutting actions supported operating margins to more than double year over year.

The Advanced Alloys & Solutions (AA&S) segment’s sales rose 13% year over year to $425.7 million, owing to reduced impacts from the strike and higher selling prices. EBITDA in the division totaled $56.8 million compared with $11 million in the prior-year quarter. Richer product mix, including a smaller proportion of standard stainless products, benefits from raw material price changes and gains from 2020 cost reductions have improved operating margin.

Financial Position

Allegheny ended the quarter with cash and cash equivalents of $1,006.8 million, up 75.9% year over year. Long-term debt increased 9.2% year over year at $1,683.6 million.

Cash used in operating activities in the first nine months of 2021 was $244.8 million.

Outlook

Allegheny expects sequential revenue and earnings growth in the fourth quarter mainly driven by the ongoing commercial aerospace recovery in the HPMC segment. Significant managed working capital reductions is expected to drive fourth-quarter cash generation.

It will temporarily curtail some early-stage manufacturing activities to align its inventory levels with market demand. The company also planned extended equipment outages to complete the transformational upgrades. These actions are anticipated to cause unfavorable cost-absorption impacts in the quarter, the company noted.

Price Performance

Shares of Allegheny have surged 81.8% in the past year compared with a 75.8% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Allegheny currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Olin Corporation OLN.

Nucor has a projected earnings growth rate of around 583.5% for the current year. The company’s shares have soared 129% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of around 86.9% for the current year. The company’s shares have gained 41.1% in the past year. It currently carries a Zacks Rank #2 (Buy).

Olin has an expected earnings growth rate of around 717% for the current year. The company’s shares have surged 242.3% in the past year. It currently flaunts a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.