Allergan (AGN) Beats on Q2 Earnings, Unveils Buyback Plan

Allergan plc’s AGN second-quarter 2018 earnings came in at $4.42 per share, which comprehensively beat the Zacks Consensus Estimate of $4.13 and came ahead of the guided range of $4-$4.20. Earnings rose 10% year over year driven by higher revenues and lower operating costs.

Revenues came in at $4.12 billion, which exceeded the Zacks Consensus Estimate of $3.92 billion as well as the guided range of $3.85 billion and $4.0 billion. Revenues rose 2.9% from the year-ago period.

Key products like Botox, Juvéderm collection of fillers, Vraylar, Linzess and Lo Loestrin pulled up the top line in the quarter. Second-quarter revenues also benefited from higher revenues from Alloderm and CoolSculpting body contouring system added from 2017 acquisitions of LifeCell and Zeltiq, respectively.

However, lower sales of Namenda XR and Estrace cream due to generic competition hurt second-quarter sales. Sales of Allergan’s blockbuster eye drug, Restasis also declined in the quarter.

While the first generic version of Alzheimer’s treatment, Namenda XR was launched by India based company, Lupin in February that of Estrace cream was launched by Mylan MYL in January.

Segment Discussion

Allergan reports revenues under three segments – U.S. General Medicine, U.S. Specialized Therapeutics and International.

U.S. Specialized Therapeutics ’net revenues increased 6.5% to $1.83 billion driven by continued strong demand trends of its facial aesthetics products, Botox and Juvéderm collection of fillers. Alloderm, CoolSculpting and Botox Therapeutic also added to sales.

In Facial Aesthetics, Botox (cosmetic) raked in sales of $236.5 million, up 12.5% year over year while Juvéderm collection of fillers rose 10.8% to $139.5 million.

In Eye Care, while Ozurdex sales rose 10.8% to $27.6 million, Restasis’ sales decreased 5.4% to $318.2 million due to lower selling price. Botox Therapeutic revenues were $404.7 million, up 16.7% driven by demand growth. Alloderm sales grew 26.6% to $107.1 million while CoolSculpting sales added $108.3 million to sales.

U.S. General Medicine net revenues were down 7.5% year over year to $1.32 billion in the reported quarter hurt by lower sales of Namenda XR and Estrace, which were partially offset by strong growth from Vraylar, Linzess and Lo Loestrin and anti-infectives.

Linzess’ sales rose 14.3% to $191.8 million while Lo Loestrin sales rose 13.1% to $127.8 million. Vraylar sales were $114.2 million in the second quarter, much higher than $84.4 million in the previous quarter.

Namenda XR sales slumped from $118.7 million to $3.4 million in the reported quarter due to generic competition following loss of exclusivity in February.

The International segment recorded net revenues of $948.9 million, up 8.1% from the year-ago period, excluding the impact of foreign exchange, driven by growth in Medical Aesthetics, Botox (therapeutic) and Eye Care.

Profits Rise

Adjusted operating income increased 4.6% to $1.97 billion in the second quarter.

Selling, general and administrative (SG&A) expenses declined 6.7% to $1.13 billion in the second quarter owing to lower promotional/advertising costs and reduction in foreign exchange losses.

Research and development (R&D) expenses also declined 1.3% to $388.9 million due to pipeline re-prioritization.

2018 Outlook

Allergan raised its earnings and sales guidance range for 2018. Allergan lifted its sales guidance to an approximate range of $15.45-$15.60 billion compared with the earlier forecast of $15.15-$15.35 billion.

Meanwhile, the company also raised its adjusted earnings expectation to the band of $16.00-$16.50 per share from $15.65-$16.25 guided earlier.

The company also raised its guidance range for adjusted tax rate, SG&A and R&D costs.

Adjusted tax rate is expected to be approximately 14.5% in 2018 compared with approximately 14% expected previously.

Adjusted gross margin guidance was maintained in the range of 85.5% and 86%, which is lower than 2017 levels. Gross margin is expected to be hurt by loss of exclusivity of high-margin products — Restasis, Estrace and Delzicol — and unfavorable product mix.

Adjusted R&D expenses are expected to be approximately $1.55 billion (previously $1.5 billion) while SG&A spend is expected to be approximately $4.35 billion (previously $4.25 billion).

Third Quarter 2018 Outlook

In third-quarter 2018, revenues are anticipated between $3.75 billion and $3.90 billion while earnings per share are likely to be between $3.80 and $4.10.

Our Take

Allergan delivered an impressive performance in the second quarter, beating estimates for both earnings and sales while also raising its full-year expectations. Meanwhile, the board authorized a new $2.0 billion share buyback plan to be deployed over the next twelve months.

Shares rose around 2% in pre-market trading. Allergan’s share price has risen 8.1% this year so far against the industry’s decline of 4.8%

Key products like Botox and Linzess and new products such as Viberzi and Vraylar will continue to support sales amid ongoing exclusivity challenges for older products. Restasis is also expected to face generic competition this year. Allergan also continues to deliver on its R&D pipeline with meaningful data readouts expected in 2018.

Allergan currently carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

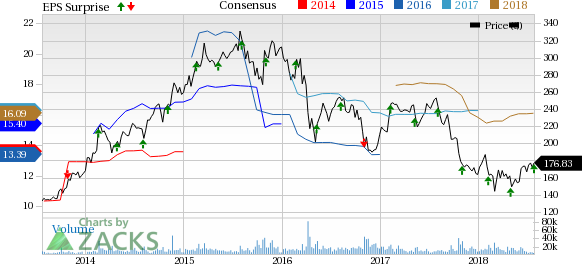

Allergan plc Price, Consensus and EPS Surprise

Allergan plc Price, Consensus and EPS Surprise | Allergan plc Quote

Other top-ranked drug-biotech stocks include Eli Lilly & Company LLY and Gilead Sciences, Inc. GILD. While Gilead has a Zacks Rank #1, Eli Lilly is a #2 Ranked stock.

Gilead’s shares have risen 10.1% this year so far while earnings estimates for 2018 have risen 0.8% over the past 30 days.

Lilly’s earnings estimates for 2018 and 2019 have risen 3.5% and 2.2%, respectively over the past 30 days. Its stock has gained 14.2% this year so far.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Allergan plc (AGN) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research