Allstate (ALL) to Post Q4 Earnings Beat on Benefits Profits

The Allstate Corporation ALL is set to beat earnings estimates for fourth-quarter 2021, whose results are set to be released on Feb 2, after the closing bell.

In the last reported quarter, the leading property-casualty insurer’s adjusted earnings per share of 73 cents missed the Zacks Consensus Estimate of $1.62, primarily due to escalating costs, elevated non-catastrophe losses in auto and homeowners insurance, and higher catastrophe losses. Yet, the downside was partly offset by improved earned premiums.

Let’s see how things have shaped up prior to the fourth-quarter earnings announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter earnings per share of $2.74 has witnessed three upward revisions and one downward movement by firms in the past 30 days. This estimate is indicative of a 53.3% decrease from the year-ago reported figure. Similarly, the Zacks Consensus Estimate for revenues is pegged at $11 billion, suggesting a decline of 3% from the year-ago reported figure.

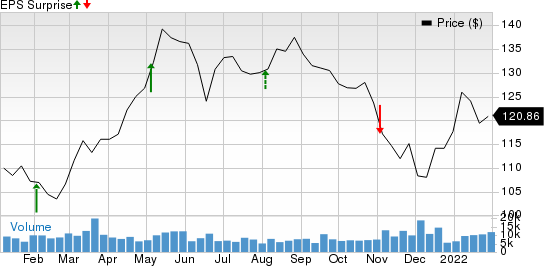

Allstate beat earnings estimates in three of the trailing four quarters and missed once, delivering an average of 21.1%. This is depicted in the graph below.

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

What the Quantitative Model Suggests

Our proven model predicts an earnings beat for Allstate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: Earnings ESP for the company is currently +2.86%. This is because the Most Accurate Estimate is pegged at $2.82 per share, higher than the Zacks Consensus Estimate of $2.74. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Allstate currently holds a Zacks Rank #3.

Factors Driving Better-Than-Expected Earnings

The company’s fourth-quarter results are likely to reflect pre-tax catastrophe losses worth $528 million. Catastrophe losses for December primarily stemmed from events bearing an estimated cost of $381 million and unfavorable reserve reestimates. It is to be noted that 78% of the month’s anticipated catastrophe losses stemmed from the Marshall Fire and December tornados. The Marshall Fire broke out in Colorado last month, which alone is expected to result in $218 million losses.

The company might have suffered a blow from the Services business (protection services) line. The consensus mark for adjusted net income for this line stands at $4 million, indicating a significant decline from the year-ago reported figure of $40 million. The Zacks Consensus Mark for net investment income from Property-Liability is pegged at $527 million, indicating a decline from $619 million in the year-ago period. All these factors might have resulted in a decrease in the bottom line from the year-ago level.

Nevertheless, revenues might have been supported by better premiums. The consensus mark for net premiums earned from the Property Liability business segment indicates an upside of 15.1% from the year-ago reported level.

The combination of attractive unit economics, a scalable technology platform and the power of The Allstate brand is expected to have led to a strong protection plan business with continued profitable growth in the fourth quarter. Also, the Zacks Consensus Mark for adjusted net income from the Allstate Benefits (Allstate Health and Benefits) unit is pegged at $49.8 million, indicating an increase from $34 million a year ago, positioning the company for an earnings beat this time around.

Other Stocks That Warrant a Look

Here are some other companies from the Financespace that you may also want to consider, as our model shows that these too have the right combination of elements to post an earnings beat this time around:

Arch Capital Group Ltd. ACGL has an Earnings ESP of +1.48% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arch Capital’s bottom line for the to-be-reported quarter indicates an 82.1% year-over-year rise.

Jones Lang LaSalle Incorporated JLL has an Earnings ESP of +9.23% and is a Zacks #2 Ranked player.

The Zacks Consensus Estimate for Jones Lang LaSalle’s earnings per share for the to-be-reported quarter signals a 26.3% year-over-year jump.

American International Group, Inc. AIG has an Earnings ESP of +4.88% and a Zacks Rank #3.

The Zacks Consensus Estimate for American International’s bottom line for the to-be-reported quarter indicates a 24.5% year-over-year increase.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research