Ally Financial (ALLY) Posts Q1 Loss on High Provisions, Costs

Ally Financial’s ALLY shares lost 2.1% following the release of first-quarter 2020 results. Adjusted loss was 44 cents per share against the Zacks Consensus Estimate for earnings of 71 cents. The figure also deteriorated from the year-ago quarterly earnings of 80 cents per share.

The results reflect substantial reserve build to combat coronavirus-related concerns, which in turn resulted in increase in credit costs. Further, decline in revenues, rise in operating expenses and lower loan balance were headwinds. However, growth in deposit balance was impressive.

After considering non-recurring items, net loss available to common shareholders (on a GAAP basis) was $319 million or 85 cents per share versus net income of $374 million or 92 cents per share recorded in the prior-year quarter.

Revenues Down, Expenses Rise

Total net revenues were $1.41 billion, declining 28.5% year over year. The figure also lagged the Zacks Consensus Estimate of $1.61 billion.

Net financing revenues were up 1.2% from the prior-year number to $1.15 billion. The rise was driven by higher retail auto portfolio yield and balance, and liability mix shift, which were partly offset by lower commercial auto balance and portfolio yield.

Adjusted net interest margin was 2.68%, down 1 basis point (bps).

Total other revenues of $266 million declined 42.9% from the prior-year level.

Total non-interest expenses increased 10.8% year over year to $920 million. The rise was mainly due to an increase in all cost components.

Adjusted efficiency ratio at the end of the first quarter was 52.3%, up from 48.9% recorded in the comparable year-ago period. A rise in efficiency ratio indicates deterioration in profitability.

Credit Quality Worsens

Non-performing loans of $1.46 billion as of Mar 31, 2020 were up 47.7% from the corresponding period of 2019. Further, net charge-off rate was 0.84%, up 11 bps.

Also, provision for loan losses surged to $903 million from $282 million recorded in the prior-year quarter. The drastic increase was due to reserve build, primarily driven by coronavirus-induced economic slowdown.

Strong Balance Sheet & Capital Ratios

Total net finance receivables and loans amounted to $124.9 billion as of Mar 31, 2020, decreasing 1.6% from the fourth quarter. Deposits totaled $122.3 billion, increasing 1.3% sequentially.

As of Mar 31, 2020, total capital ratio was 12.8%, improving from 12.5% in the comparable period of last year. Tier I capital ratio was 10.9% as of Mar 31, 2020, down from 11.0% in the corresponding period of 2019.

Share Repurchases

During the quarter, the company repurchased shares worth $104 million. However, in mid-March, it suspended the share buyback plan through second-quarter 2020 amid coronavirus concerns.

Our Take

Steady growth in revenues and deposits, along with decent loan demand will likely continue to support Ally Financial’s profitability. However, persistently rising expenses and provisions (as witnessed during the quarter) will likely hurt profitability. Also, lower interest rates remain a major concern.

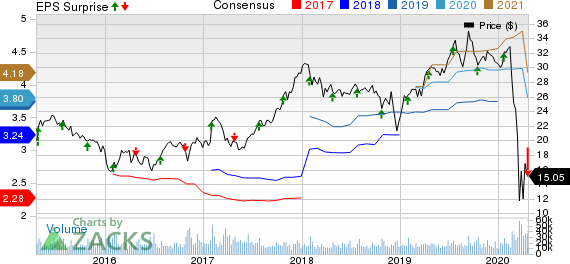

Ally Financial Inc. Price, Consensus and EPS Surprise

Ally Financial Inc. price-consensus-eps-surprise-chart | Ally Financial Inc. Quote

Currently, Ally Financial carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Date of Other Banks

Bank OZK OZK, Associated Banc-Corp ASB and SVB Financial SIVB are scheduled to announce first-quarter results on Apr 23.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SVB Financial Group (SIVB) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research