Ally Financial (ALLY) Stock Dips 5.1% Despite Q3 Earnings Beat

Ally Financial’s ALLY third-quarter 2021 adjusted earnings of $2.16 per share convincingly surpassed the Zacks Consensus Estimate of $1.96. The bottom line showed a rise of 72.8% from the year-ago quarter’s number.

Results benefited primarily from an improvement in revenues and lower provisions. Also, loans and deposit balances increased sequentially. However, a rise in expenses hurt results to some extent. Probably, because of this, shares of the company lost 5.1% following the release.

After considering non-recurring items, net income (on a GAAP basis) was $683 million or $1.89 per share, up from $476 million or $1.26 per share in the prior-year quarter.

Revenues Improve, Expenses Rise

Total GAAP net revenues were $1.99 billion, up 17.9% year over year. The reported figure was in line with the Zacks Consensus Estimate.

Net financing revenues were up 32.8% from the prior-year quarter to $1.59 billion. The rise was driven by lower funding costs and higher consumer auto revenues, partially offset by lower commercial auto portfolio balances.

Adjusted net interest margin was 3.68%, up 101 basis points (bps) year over year.

Total other revenues were $391 million, down 19.2% from the prior-year quarter.

Total non-interest expenses were up 10.7% year over year to $1.00 billion. The upswing stemmed from a rise in compensation and benefits expenses, and other operating expenses.

The adjusted efficiency ratio at the end of the third quarter was 41.7%, down from 47.3% in the year-ago period. A decline in efficiency ratio indicates an improvement in profitability.

Credit Quality Improves

Non-performing loans of $1.29 billion as of Sep 30, 2021, were down 13.9% year over year. In the reported quarter, the company recorded net charge-offs of $54 million, down 55.7% from the prior-year quarter.

Provision for loan losses of $76 million declined 48.3% from the prior-year quarter.

Loans & Deposit Balances Rise

As of Sep 30, 2021, total net finance receivables and loans amounted to $111.3 billion, up from $109.1 billion recorded in second-quarter 2021. Also, deposits increased marginally from the previous quarter’s end to $139.4 billion.

Capital Ratios Improve

As of Sep 30, 2021, total capital ratio was 14.6%, up from 14.1% in the prior-year quarter. Tier I capital ratio was 12.8%, up from 12.1% as of Sep 30, 2020.

Share Repurchase Update

In the reported quarter, the company repurchased shares worth $679 million.

Our View

Ally Financial’s initiatives to diversify the revenue base will likely keep aiding its profitability. Given a solid balance sheet, the company remains well-poised to expand through acquisitions. However, persistently rising expenses (mainly owing to the company’s inorganic growth efforts) will likely hurt bottom-line growth.

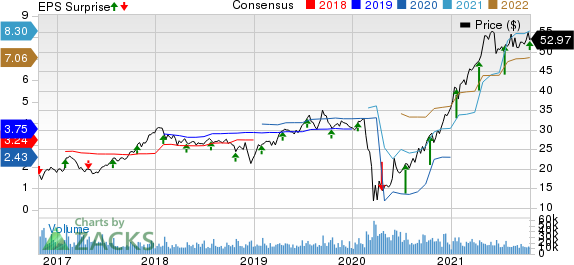

Ally Financial Inc. Price, Consensus and EPS Surprise

Ally Financial Inc. price-consensus-eps-surprise-chart | Ally Financial Inc. Quote

Currently, Ally Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Consumer Loan Providers

Capital One COF and Navient Corporation NAVI are scheduled to report quarterly results on Oct 26. Enova International ENVA will report results on Oct 28.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

Enova International, Inc. (ENVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research