How Alphabet Inc and Other Hedge Fund Favorites Performed in Q2

Insider Monkey tracks hedge funds, billionaires, and prominent value investors for a very simple reason: their consensus picks generally outperform the market. We aren’t the only research shop broadcasting this fact using a bullhorn. Here is what strategist Ben Snider said in Goldman Sachs’ periodic hedge fund report:

“Despite the strong track record of popular hedge fund stocks, investors often view high ownership as a negative trait when evaluating stock prospects. Clients often ask us to include hedge fund ownership data in stock screens, expressing a preference for buying ‘under-owned’ stocks.”

“In fact, during the past decade hedge fund popularity has been a more useful criterion for selecting stocks than valuations…. The signals from hedge fund popularity and valuation have been particularly useful in combination, especially for investors with slightly longer investment horizons. During the past decade, popular stocks have generally outperformed unpopular stocks across both 3- and 12-month investment horizons” Snider concluded.

It may sound like I am tooting my own horn, but Insider Monkey’s quarterly newsletter is actually superior to Goldman’s report. That’s because we separated the hedge fund favorites into long and short buckets. Our long bucket of hedge fund favorites returned 34.1% in the first half of 2019, whereas our short bucket of hedge fund favorites gained 21.4% during the same period. Hedge funds’ favorite top 20 stocks, on the other hand, returned 24% so far in 2019. You could have beaten the S&P 500 Index funds by 5.7 percentage points by investing in hedge funds’ top 20 picks in 2019, whereas you could have outperformed the index funds by 15.8 percentage points if you invested in our top hedge fund picks. You can try out our newsletter free of charge for 14 days to see hedge funds’ latest best stock picks.

The #4 most popular stock among the 743 hedge funds tracked by Insider Monkey was Alphabet Inc (NASDAQ:GOOGL). Alphabet was also the fourth most popular stock among hedge funds at the end of December (see the 30 most popular stocks among hedge funds).

We have to warn you against indiscriminately imitating hedge funds' all stock picks. Hedge funds' top 20 stock picks outperformed the S&P 500 Index funds by 5.7 percentage points this year, but hedge funds' top 500 stock picks had the same return as the S&P 500 Index this quarter. Investing in a hedge fund's 35th best idea doesn't give you the same return as investing in a hedge fund's best idea.

We're going to take a look at the fresh hedge fund action encompassing Alphabet Inc (NASDAQ:GOOGL).

How have hedgies been trading Alphabet Inc (NASDAQ:GOOGL)?

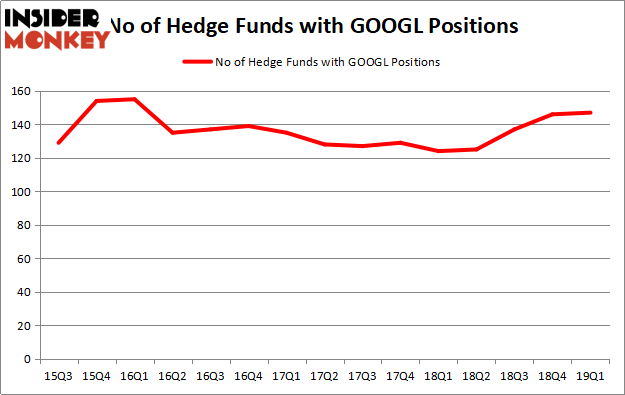

Heading into the second quarter of 2019, a total of 147 of the hedge funds tracked by Insider Monkey were long this stock, a change of 1% from one quarter earlier. By comparison, 124 hedge funds held shares or bullish call options in GOOGL a year ago. With the smart money's positions undergoing their usual ebb and flow, there exists an "upper tier" of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Alphabet Inc (GOOGL), with a stake worth $1381.7 million reported as of the end of March. Trailing Fisher Asset Management was Citadel Investment Group, which amassed a stake valued at $1014.4 million. AQR Capital Management, Diamond Hill Capital, and Glenview Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers have jumped into Alphabet Inc headfirst. OZ Management, managed by Daniel S. Och, established the most valuable call position in Alphabet Inc (NASDAQ:GOOGL). OZ Management had $107.5 million invested in the company at the end of the quarter. John Hempton's Bronte Capital also initiated a $35.1 million position during the quarter. The other funds with new positions in the stock are Mark Kingdon's Kingdon Capital, Eric W. Mandelblatt and Gaurav Kapadia's Soroban Capital Partners, and Clint Carlson's Carlson Capital.

Let's also examine hedge fund activity in other stocks similar to Alphabet Inc (NASDAQ:GOOGL). We will take a look at Alphabet Inc (NASDAQ:GOOG), Berkshire Hathaway Inc. (NYSE:BRK-B), Facebook Inc (NASDAQ:FB), and Alibaba Group Holding Limited (NYSE:BABA). This group of stocks' market caps resemble GOOGL's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position GOOG,133,13597514,-8 BRK-B,91,20086059,4 FB,176,18349790,15 BABA,117,13936754,4 Average,129.25,16492529,3.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 129.25 hedge funds with bullish positions and the average amount invested in these stocks was $16493 million. That figure was $11115 million in GOOGL's case. Facebook Inc (NASDAQ:FB) is the most popular stock in this table. On the other hand Berkshire Hathaway Inc. (NYSE:BRK-B) is the least popular one with only 91 bullish hedge fund positions. Alphabet Inc (NASDAQ:GOOGL) is not the most popular stock in this group but that's only because of Facebook. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.4% in Q2 and outperformed the S&P 500 ETF (SPY) by more than 2 percentage points. Unfortunately GOOGL wasn't nearly as successful a bet as these 20 stocks and hedge funds that were betting on GOOGL were disappointed as the stock returned -8% during the same period and underperformed the market.

We should note that hedge funds' top 3 stock picks returned more than 35% so far this year and beat the S&P 500 Index Fund (IVV) by 17 percentage points.

Disclosure: None. This article was originally published at Insider Monkey.