Is Alphabet's (NASDAQ:GOOG.L) Share Price Gain Of 132% Well Earned?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the Alphabet Inc. (NASDAQ:GOOG.L) share price has soared 132% in the last half decade. Most would be very happy with that.

See our latest analysis for Alphabet

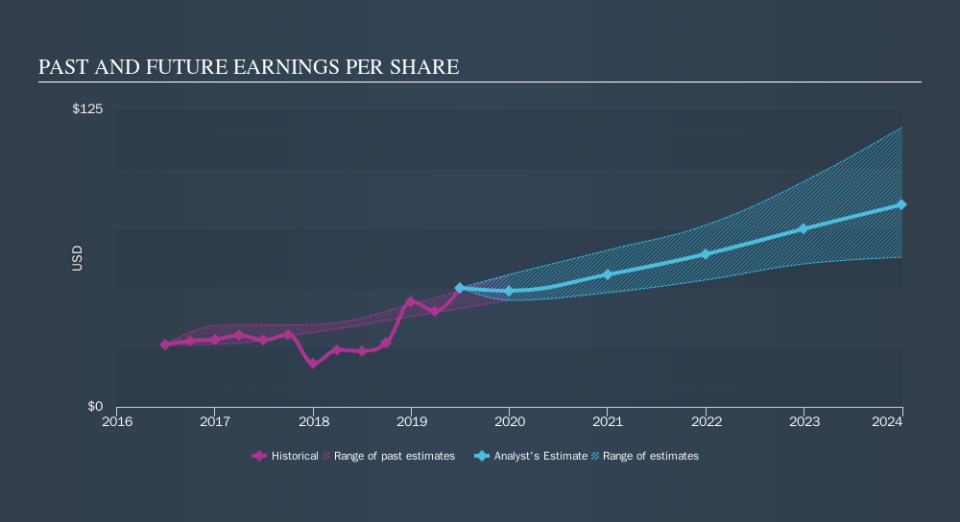

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Alphabet achieved compound earnings per share (EPS) growth of 19% per year. This EPS growth is remarkably close to the 18% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. In fact, the share price seems to largely reflect the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Alphabet's earnings, revenue and cash flow.

A Different Perspective

Alphabet provided a TSR of 8.5% over the year. That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 18% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. Before deciding if you like the current share price, check how Alphabet scores on these 3 valuation metrics.

But note: Alphabet may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.