Altice (ATUS) Beats Q4 Earnings Estimates on Higher Revenues

Altice USA, Inc. ATUS reported solid fourth-quarter 2020 results with the top line and bottom line beating the respective Zacks Consensus Estimate. Despite a challenging macroeconomic environment, the company recorded solid customer additions driven by resilience in the business model and is likely to continue witnessing this growth momentum in 2021.

Bottom Line

Net income in the December quarter was $330.5 million or 60 cents per share compared with $0.3 million or breakeven results on per share basis in the prior-year quarter. The improvement was primarily attributable to loss on extinguishment of debt in the prior-year quarter and lower restructuring expenses in the reported quarter. The bottom line surpassed the Zacks Consensus Estimate by 25 cents. In full-year 2020, the company recorded net income of $436.2 million or 75 cents per share compared with $138.9 million or 21 cents per share in 2019.

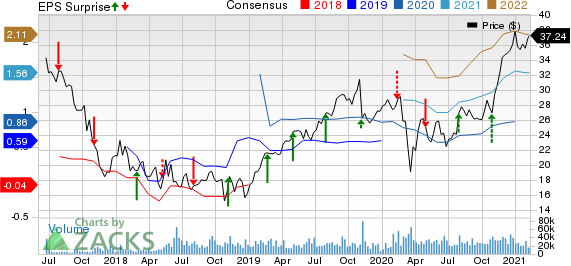

Altice USA, Inc. Price, Consensus and EPS Surprise

Altice USA, Inc. price-consensus-eps-surprise-chart | Altice USA, Inc. Quote

Revenues

Fourth-quarter total revenues increased 2.5% year over year to $2,535.4 million on higher Broadband (up 14%) and News & Advertising revenues (up 29.7%). The top line beat the consensus mark of $2,530 million. In full-year 2020, the company recorded total revenues of $9,894.6 million compared with $9,760.8 million in 2019.

The company witnessed robust demand for its broadband service and a 47% year-over-year increase in average data usage per customer to approximately 468 GB per month (roughly 591 GB per month for broadband-only customers). The company has accelerated the deployment of 1-gig speeds, which are currently available in more than 92% of its geographical footprint. Residential revenue per customer relationship declined 1.8% year over year to $140.09.

Business Services revenues remained relatively flat at $362.2 million. News and Advertising revenues improved with gradual recovery in local advertising and higher political advertisements.

Other Details

Operating income improved to $608.7 million from $427.3 million in the year-ago quarter. Adjusted EBITDA was $1,151 million compared with $1,085 million in the prior-year quarter. In the fourth quarter, Altice repurchased 87.3 million shares for an aggregate price of about $3 billion, at an average price of $34.21.

During the quarter, Altice closed the divesture of about 50% of its stake in Lightpath fiber enterprise business for an implied enterprise value of $3.2 billion. The company retains a little more than 50% interest in Lightpath and maintains control of the business.

Cash Flow & Liquidity

In 2020, Altice generated a cash flow of $2,980.2 million compared with $2,554.2 million a year ago. Free cash flow in 2020 was $1,906.2 million compared with $1,198.8 million in 2019. As of Dec 31, 2020, cash and cash equivalents were $278.7 million with net debt of $24,962 million.

2021 Outlook

Altice expects the macroeconomic impact from the COVID-19 pandemic to affect its operations, particularly in News and Advertising, and SMB businesses. Although this lowers revenues and EBITDA visibility, the company remains confident of its ability to deliver revenue and adjusted EBITDA growth in 2021 while maintaining leverage and share repurchase targets. The company currently anticipates capital expenditures in 2021 to be within $1.3 billion to $1.4 billion with a year-end leverage target of less than 5.3x.

Zacks Rank & Stocks to Consider

Altice currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry are Knowles Corporation KN, sporting a Zacks Rank #1 (Strong Buy), and Viavi Solutions Inc. VIAV and Corning Incorporated GLW, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Knowles has a long-term earnings growth expectation of 10%. It delivered a positive earnings surprise of 19.3%, on average, in the trailing four quarters.

Viavi delivered a positive earnings surprise of 20.2%, on average, in the trailing four quarters.

Corning has a long-term earnings growth expectation of 2%. It delivered a positive earnings surprise of 41.6%, on average, in the trailing four quarters.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corning Incorporated (GLW) : Free Stock Analysis Report

Knowles Corporation (KN) : Free Stock Analysis Report

Viavi Solutions Inc. (VIAV) : Free Stock Analysis Report

Altice USA, Inc. (ATUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.