Amarin (NASDAQ:AMRN) Shareholders Have Enjoyed A Magnificent 1356% Share Price Gain

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Amarin Corporation plc (NASDAQ:AMRN) share price has soared 1356% over five years. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen -3.9% in thirty days.

It really delights us to see such great share price performance for investors.

See our latest analysis for Amarin

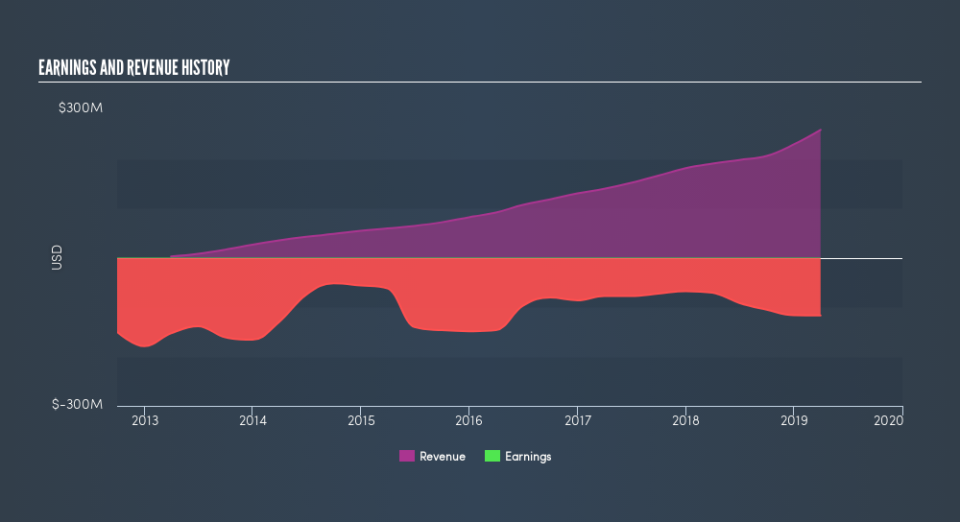

Amarin isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Amarin can boast revenue growth at a rate of 34% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 71% per year in that time. It's never too late to start following a top notch stock like Amarin, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Amarin's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Amarin shareholders have received a total shareholder return of 663% over the last year. That gain is better than the annual TSR over five years, which is 71%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Amarin better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.