How AMAT, KLAC, LRCX, and AMD may be Impacted by Future Licensing Requirements for China

First appeared on Simply Wall St News

Key takeaways:

The U.S. administration is may widen the restrictions on exports of semiconductors to China in order to limit China's ability to import technology that can be used against U.S. national security interests.

Stocks like AMAT, KLAC, LRCX have 27%+ revenue exposure to the Chinese market which may be affected.

The U.S. is still weighing the extent to which NVDA and AMD should be affected by future regulations.

News broke that the U.S. administration intends to widen the restriction on exports of semiconductors to China. The goal of these actions is to limit China's ability to import technology that can be used against U.S. national security interests.

The Commerce Department plans to publish new guidelines based on restrictions outlined in letters sent to Applied Materials ( NASDAQ : AM AT ), K LA Corporation ( NAS DAQ : KLAC ), and Lam Research ( NASDAQ :LRCX ), possibly prohibiting the organizations from exporting chip-making equipment used in the production of sub-14 nanometer processes. The risks that these may companies face seem categorical in nature - meaning that abrupt changes can occur if they can't meet future licensing requirements.

Should these policies broaden, companies like Advanced Micro Devices, Inc. ( NASDAQ:AMD ) and NVIDIA Corporation ( NASDAQ: NV DA ) may be even more affected. NVIDIA is already estimating some $400m annual revenue exposure from the action, which has been reflected in the current sentiment of the stock.

In this analysis, we will recap the fundamentals of the mentioned stocks and outline their possible revenue exposure from these markets.

Applied Materials

Applied Materials is a company that provides equipment and services to the semiconductor, display, and related industries. The company operates in three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets.

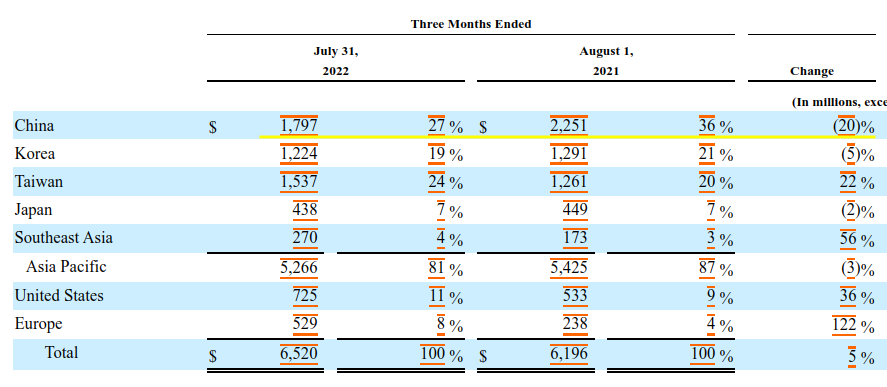

In the table below taken from the company's latest quarterly filings, we can see that 27% of revenues come from China, and that percentage has already decreased 20% YoY.

Before the news, analysts have been predicting a stabilization of revenue for the company, but investors should keep an eye for the updates, as this may change in the future:

According to our analysis, the stock is fundamentally undervalued, has strong fundamentals with a 26.4% profit margin and trading at a 12.5x PE ratio. However, investors may want to look at insider transactions, as some owners have recently sold their stock.

KLA Corporation

K LA Corporation operates through a direct sales force, original equipment manufacturers, and distributors in the United States, Europe, Japan, Korea, Taiwan, China, and Southeast Asia.

K LA is a company that designs, manufactures, and markets process control and yield management solutions for the semiconductor and related electronics industries worldwide. The company operates through four segments: Semiconductor Process Control, Specialty Semiconductor Process, PCB, Display and Component Inspection, and Other.

The company has already noted the risk of its China operations in its 2022 Annual Report (p. 2) :

"Although China is currently seen as an important long-term growth region for the semiconductor capital equipment sector, the U.S. Department of Commerce (“Commerce”) has added certain China-based entities to the U.S. Entity List, restricting our ability to provide products and services to such entities without a license . In addition, Commerce has imposed export licensing requirements on China-based customers engaged in military end uses, as well as requiring our customers to obtain an export license when they use certain semiconductor capital equipment based on U.S. technology to manufacture products connected to Huawei or its affiliates. While these new rules have not significantly impacted our operations to date, such actions by the U.S. government or another country could impact our ability to provide our products and services to existing and potential customers and adversely affect our business. "

KLA has large international exposure, as 90% of their revenues come from markets outside the U.S. Here is a three-year breakdown of the revenue by geography from the company's annual report:

It seems that the Chinese market is the largest for the company, and a disruption here may cripple the company's business prospects.

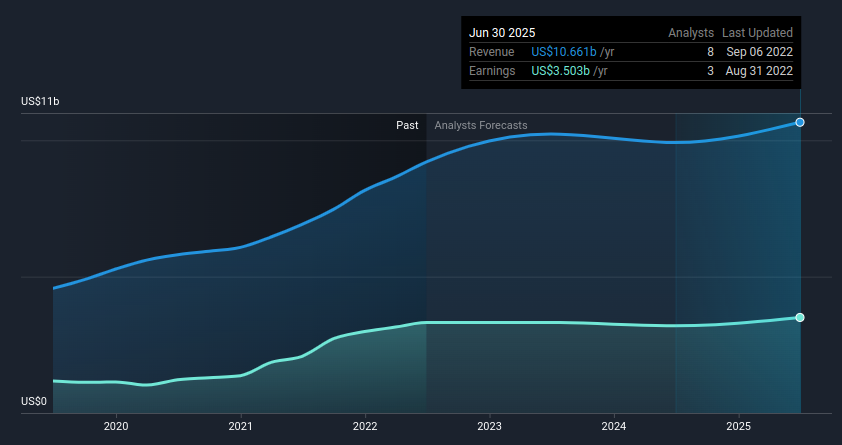

Analysts covering the company are predicting some revenue volatility in the future, but part of the risk surrounding the exposure is uncertain, which may partly be the reason why the company is trading at a low 15.3x PE despite having a wide 36% profit margin and historically growing $3.3b in net income. Here are the forecasts for the company going as far as Q2 2025:

The company seems to be increasing its reliance on debt , which doesn't seem to pose a risk yet given its debt to market cap of 13%. Should the company be faced with hurdles in its Chinese segment, it may have to tighten investor returns, and dividends may not be increased for some time.

Lam Research

Lam Research Corporation designs and manufactures semiconductor processing equipment used in the fabrication of integrated circuits. The company offers various products for deposition, plasma-enhanced CVD, atomic layer deposition, dielectric etch, conductor etch, and through-silicon via etch applications. It also provides bevel clean products, wafer cleaning products, and mass metrology systems.

The company sells its products and services to semiconductors industry in the United States and internationally. The table below shows their revenue breakdown by geography:

We can see that China is the largest importer, with 31% of revenues of Lam's sales going to that market. The company acknowledges that this market may be materially affected by new licensing requirements from the U.S.:

"Our Sales to Customers in China, a Region of Growing Significance to Us, Could be Materially and Adversely Affected by Export License Requirements and Other Regulatory Changes, or Other Governmental Actions in the Course of the Trade Relationship Between the U.S. and China".

Analysts are attempting to estimate the possible impact on earnings should the situation escalate, but it may be a bit early to get a better sense of the extent of the impact, so investors may want to keep track of the company in their watchlist.

The chart below shows the current estimates - last updated on Sep 8th 2022, for Lam Research:

The company has negative stock performance in the last year, and is down by some 26.5%. Investors are also faced with multiple fundamental risks for Lam, such as:

On the other hand, we see that the stock is likely undervalued and trading around 13.3x PE.

Advanced Micro Devices

AMD is a semiconductor company that operates in two segments: Computing and Graphics; and Enterprise, Embedded and Semi-Custom.

The company's products include x86 microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUs, and development services. AMD also offers server and embedded processors, and semi-custom System-on-Chip (SoC) products, development services, and technology for game consoles. Part of these products can be used or repurposed for supporting a technology infrastructure that can be used against U.S. national security, which is why the company may be faced with expanding regulation on sales to China and international markets.

The company is also highly exposed to international markets and faces a series of two-way risks both for importing components and selling products. In their latest quarterly filing (p. 58) they note:

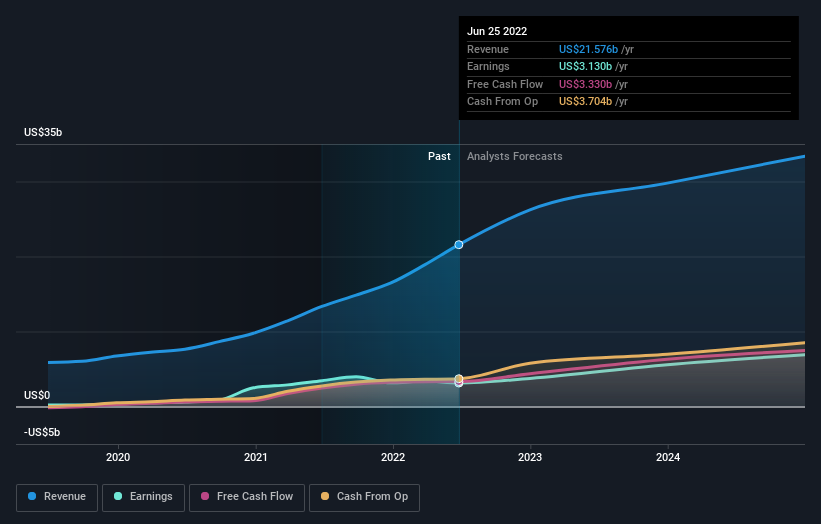

"We also have international sales operations. International sales, as a percent of net revenue, were 70% for the three months ended June 25 2022."

Although revenues of $6.6b were in line with analyst predictions, statutory earnings fell badly short, missing estimates by 68% to hit $0.27 per share. Investors are again preparing for a possible change in estimates by analysts, and the current forecast picture may change should the U.S. choose to expand the regulations:

Before the indications on regulation expansion, the 39 analysts covering Advanced Micro Devices were predicting revenues of $26.2b in 2022. This would reflect a substantial 22% improvement in sales compared to the last 12 months.

The company also has some fundamentals risks worth reviewing. We discovered 3 warning signs we think you should be aware of.

Next Steps

The situation is still developing and is too early to estimate the immediate impact. Investors may want to ask themselves the (admittedly) obvious question: how they view the future cooperation between China and the U.S.?

This can help when looking for future investment decisions as investors that foresee a deterioration of relations may be inclined to look for companies that are committing to onshore production and sales, vs investors that are bullish on international trade and think that this period of uncertainty will allow them to buy great stocks at bargain prices.

You can find curated lists of great companies suitable for different investment strategies in our Discover section.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here