Amazon's AWS Clientele Strengthens With The Globe and Mail

Amazon AMZN continues to reinforce market position in the cloud industry on the back of improving clientele of its cloud computing arm, Amazon Web Services (AWS).

The recent selection of AWS by The Globe and Mail, a Canada-based news media company, as its preferred cloud provider provided a further boost to the endeavor. Further, the latter considers the cloud giant to be the standard for artificial intelligence (AI) and machine learning (ML) workloads.

This highlights the efficiency and reliability of AWS’ innovative cloud products and services.

In fact, The Globe and Mail leverages AWS to run its popular recommendation engine and proprietary Sophi predictive analytics platform. Further, the media company also utilizes Amazon Polly, which converts text articles to audio in English, French, and Mandarin.

Most importantly, Amazon SageMaker, Amazon Comprehend, Amazon Rekognition, and Amazon Textract, which are being leveraged by The Globe and Mail’s reporters and editors to a great extent, are aiding them in finding and promoting stories without any manual review, custom code and ML experience.

Strengthening Clientele

Amazon’s strong focus toward improvement of its service portfolio will continue to strengthen its cloud customer base.

The recent decision of The Globe and Mail is in sync with AWS’ client acquisition strategy. Apart from this, AWS acquired another client — Pro Football Focus (PFF), a subscription-based analytics service. Notably, the latter selected AWS as its official cloud and ML provider and has transitioned its entire infrastructure to AWS.

Further, Amazon also added — National Association for Stock Car Auto Racing and Sony Music Entertainment Japan, to name a few, to customer base in the second-quarter 2019. Notably, AWS revenues of $8.38 billion improved 37.3% year over year and accounted for 13.2% of net sales.

We believe expanding client base will continue to drive the top line in the near term as well as the long haul.

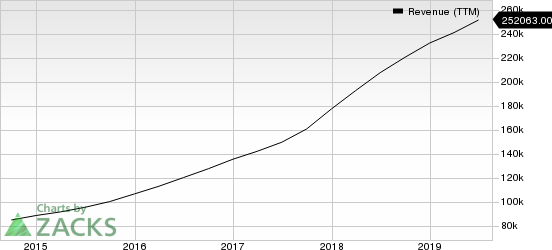

Amazon.com, Inc. Revenue (TTM)

Amazon.com, Inc. revenue-ttm | Amazon.com, Inc. Quote

AWS to Sustain Dominance, Competition Intensifies

Per a report from MarketsandMarkets, the global cloud computing market is expected to hit $623.3 billion by 2023. Further, it anticipated to witness a CAGR of 18% between 2018 and 2023.

Increasing client acquisition by Amazon will aid it sustaining its dominant position in this potential market and reap benefits from it. With Microsoft MSFT and Alphabet’s GOOGL Google, Alibaba BABA and International Business Machines also working hard to bridge the gap with AWS, this move will only intensify the competition.

Per Synergy Research Group’s data, Azure and Google Cloud acquired a market share of 16% and 8%, respectively, in second-quarter 2019. However, the figures are way behind AWS’ market share of 33%, which in turn keeps Amazon the dominant force in the cloud space.

We believe robust AWS portfolio and the offering of special discounts on long-term deals and advanced payments remain the key catalysts.

Currently, Amazon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research