Ameren's (AEE) Q4 Earnings Lag Estimates, Revenues Beat

Ameren Corporation’s AEE fourth-quarter 2021 earnings of 48 cents per share from continuing operations missed the Zacks Consensus Estimate of 50 cents by 4%. However, the reported figure improved 4.3% from 46 cents reported in the year-ago quarter.

The year-over-year bottom-line improvement can be primarily attributed to increased infrastructure investments across all the company’s business segments.

For 2021, the company generated earnings of $3.84 per share, up from $3.50 during 2020. The full-year earnings however missed the Zacks Consensus Estimate of $4.03.

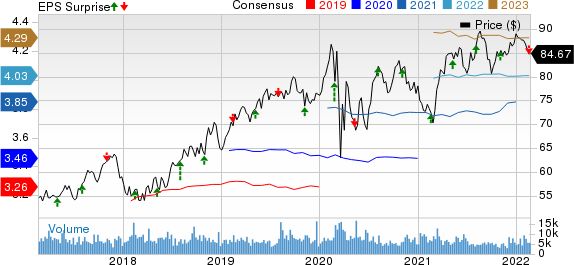

Ameren Corporation Price, Consensus and EPS Surprise

Ameren Corporation price-consensus-eps-surprise-chart | Ameren Corporation Quote

Total Revenues

Total revenues came in at $1,545 million in the reported quarter, which improved 16.3% year over year due to higher electric as well as natural gas revenues. Revenues also beat the Zacks Consensus Estimate of $1,389 million by 11.3%.

In 2021, Ameren generated revenues worth $6.39 billion, reflecting an improvement from $5.79 billion of revenues generated during 2020. The full-year revenues however missed the Zacks Consensus Estimate of $6.51 billion.

Highlights of the Release

Ameren’s total electricity sales volumes rose 11.8% to 18,180 million kilowatt-hours (kWh) compared with 16,254 million kWh witnessed in the year-ago quarter. However, gas volumes dropped 3.6% to 54 million dekatherms.

Total operating expenses were $1,348 million, up 20.7% year over year.

The company’s interest expenses in the fourth quarter were $93 million compared with the prior-year quarter’s $108 million.

Segment Results

The Ameren Missouri segment reported earnings of $518 million in 2021 compared with $436 million recorded in 2020. The year-over-year improvement can be attributed to earnings on infrastructure investments, including wind generation, and higher electric retail sales as the economy continues to recover from the impacts of COVID-19. The earnings also increased due to new electric service rates effective Apr 1, 2020.

The Ameren Illinois Electric Distribution segment reported earnings of $165 million for 2021 compared with $143 million registered in 2020. The year-over-year improvement was driven by increased earnings on infrastructure investments and a higher allowed return on equity due to a higher average 30-year U.S. Treasurybond yield in 2021 compared with 2020.

The Ameren Illinois Natural Gas segment generated earnings of $108 million for 2021 compared with $99 million in the prior year. This year-over-year improvement was led by higher delivery services rates effective late January 2021, which incorporated increased infrastructure investments.

The Ameren Transmission segment reported earnings of $230 million in 2021, compared with $216 million in the prior year. The improvement can be attributed to higher earnings from infrastructure investment.

Financial Condition

Ameren reported cash and cash equivalents of $8 million as of Dec 31, 2021, compared with $139 million registered at 2020-end.

As of Dec 31, 2021, long-term debt totaled $12,562 million compared with $11,078 million as of Dec 31, 2020.

During 2021, cash flow from operating activities amounted to $1,661 million compared with $1,727 million generated in the prior-year period.

Guidance

Ameren provided its 2022 guidance. The company currently expects to generate earnings per share in the range of $3.95-$4.15. Currently, the Zacks Consensus Estimate for 2022 earnings is pegged at $4.29 per share, higher than the guidance.

Zacks Rank

Ameren currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

NextEra Energy NEE reported fourth-quarter 2021 adjusted earnings of 41 cents per share, which beat the Zacks Consensus Estimate of 40 cents by 2.5%. The bottom line was also up 2.5% from the prior-year quarter.

NextEra’s operating revenues were $5,046 million, which lagged the Zacks Consensus Estimate of $5,436 million by 7.2%. Nonetheless, the top line improved 14.8% year over year.

CMS Energy Corporation CMS reported fourth-quarter 2021 adjusted earnings per share (EPS) of 47 cents from continuing operations, which came in line with the Zacks Consensus Estimate. The reported figure declined 2.1% on a year-over-year basis.

CMS Energy’s operating revenues were $2,033 million, which exceeded the Zacks Consensus Estimate of $1,754 million by 15.9%. The top line also improved 17.7% on a year-over-year basis.

Xcel Energy Inc. XEL posted fourth-quarter 2021 operating earnings of 58 cents per share, which matched the Zacks Consensus Estimate. The bottom line also rose 7.4% from the year-ago earnings of 54 cents.

Xcel Energy’s fourth-quarter revenues of $3,355 million beat the Zacks Consensus Estimate of $3,136 million by 7%. The same improved 14% from the prior-year quarter’s $2,947 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research