American Axle's (AXL) Q1 Earnings Trump Estimates, Down Y/Y

American Axle & Manufacturing Holdings, Inc. AXL posted first-quarter 2020 adjusted earnings of 20 cents per share, as against the Zacks Consensus Estimate of loss of 16 cents on higher-than-anticipated revenues. The bottom-line figure, however, slumped 44.4%, year on year.

The company reported net loss of $501.3 million in the quarter, as against the net income of $41.6 million recorded in the year-ago period.

The Detroit-based global automotive parts supplier reported revenues of $1,344 million, beating the Zacks Consensus Estimate of $1,297 million. Revenues, however, came in lower than the year-ago figure of $1,719 million.

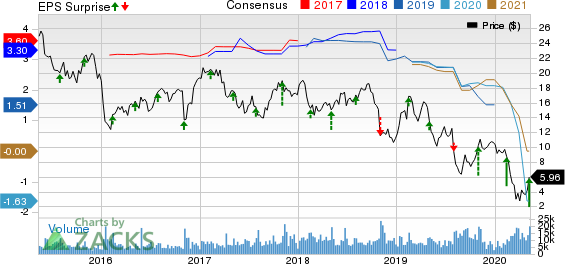

American Axle Manufacturing Holdings Inc Price, Consensus and EPS Surprise

American Axle Manufacturing Holdings Inc price-consensus-eps-surprise-chart | American Axle Manufacturing Holdings Inc Quote

Segmental Highlights

The firm’s Driveline segment recorded sales of $1,031.7 million, down 11.5% year over year. The unit EBITDA also declined 2.4% from the prior-year quarter to $139.3 million. The figure missed the Zacks Consensus Estimate of $150 million.

The company’s Metal Forming business generated revenues of $422.3 million, lower than the year-ago figure of $483.3 million. Its EBITDA also decreased $10.4 million year on year to $74 million. The reported figure also missed the Zacks Consensus Estimate of $78 million.

Costs & Financial Position

American Axle’s SG&A (selling, general & administrative) expenses totaled $90.3 million in first-quarter 2020, down from the $90.7 million incurred in the prior-year period.

For the three-month period ended Mar 31, 2020, the company’s adjusted free cash flow (FCF) was $83.3 million compared with the negative adjusted FCF of $188.5 million witnessed in the year-earlier period. Capital spending in the quarter came in at $69.2 million, down from the year-ago quarter’s $123.9 million.

As of Mar 31, 2020, American Axle had cash and cash equivalents of $682.7 million, compared with $532 million as of Dec 31, 2019. The company had net long-term debt of $3,511.7 million as of Mar 31, 2020, down from $3,612.3 million as of Dec 31, 2019.

2020 Outlook

American Axle suspended the 2020 guidance as it expects the coronavirus pandemic’s impact to strain its operations in the days to come.

Zacks Rank & Stocks to Consider

American Axle currently carries a Zacks Rank of 3 (Hold).

Some better-ranked stocks in the same sector are Veoneer, Inc. VNE, Unique Fabricating, Inc. UFAB and Modine Manufacturing Company MOD, each carrying a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Axle Manufacturing Holdings Inc (AXL) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

Unique Fabricating Inc (UFAB) : Free Stock Analysis Report

Veoneer Inc (VNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research