American Equity (AEL) OKs Share Buyback, Boosts Shareholder Value

The board of directors of American Equity Investment Life Holding Company AEL authorized a share buyback program to return more value to investors. The insurer inked an accelerated share repurchase agreement with JP Morgan to buy back $200 million worth of the company’s shares.

Post completion of the ASR, AEL will have about $276 million remaining under the share repurchase program.

From the inception of the share repurchase program in 2020 through Dec 31, 2022, AEL bought back about 23.9 million shares. The insurer also bought back about 2.437 million shares year to date. In November 2022, AEL’s board approved a $400-million share buyback program in tandem with the AEL 2.0 strategy.

American Equity Investment Life Insurance Company is a leader in the development and sale of fixed index and fixed rate annuity products. The execution of the AEL 2.0 strategy remains on track. AEL expects around one-third of the new business flow to convert into the return on asset business through growth in reinsured liabilities. Thus, the insurer believes its mix of fee revenues will support a higher-return business profile.

Banking on operational strength, this Zacks Rank #3 (Hold) insurer engages in effective capital deployment. Apart from share buyback, AEL has hiked dividends each year since 2003, when it went public. Its dividend increased at a 20-year CAGR (2003-2022) of 19.6%.

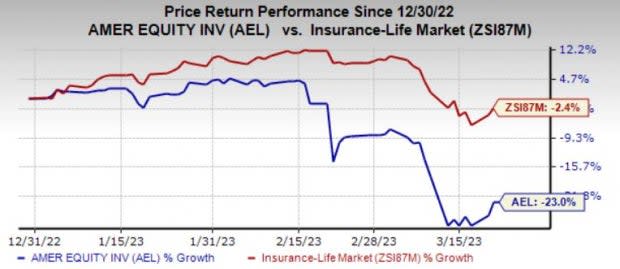

Shares of AEL have lost 23% year to date versus the industry’s decline of 2.4%. Focus on expansion into new verticals, the increasing popularity of index products in the market, solid balance sheet and effective capital deployment should help AEL bounce back.

Image Source: Zacks Investment Research

Given a solid capital level in the insurance industry and an improving operating backdrop favoring strong operational performance, insurers like Horace Mann Educators Corporation HMN, Chubb Limited CB and Cincinnati Financial Corporation CINF have resorted to effective capital deployment to enhance shareholders’ value.

Horace Mann’s board of directors approved a 3.1% hike in its quarterly dividend, marking marks the 15th consecutive yearly hike. Strategic focus on designing products to capitalize on the potential opportunity in the K-12 educator market, annuity reinsurance agreement, profitable in-force block, high quality and well-diversified investment portfolio, and cost-saving initiatives are likely to help Horace Mann increase dividends. HMN targets a 50% dividend payout ratio.

Chubb’s board looks to increase its annual dividend by 3.6%. Chubb’s dividends have witnessed an eight-year CAGR (2022-2023) of 2.4%. Its dividend yield of 1.6% betters the industry average of 0.3%. Chubb maintained a strong balance sheet and financial flexibility, including consistent cash flow generation, for the past many years. The insurer’s cash flow has been increasing over the years. This has paved the way for prudent capital deployment measures.

Cincinnati Financial’s board of directors approved a dividend of 75 cents per share for the first quarter of 2023, reflecting a 9% increase. This action sets the stage for the 63rd consecutive year of dividend hike. This reflects Cincinnati Financial’s strong operating performance, the board's positive outlook and confidence in outstanding capital, liquidity and financial flexibility.

Shares of CINF gained 8.6% year to date while that of HMN and CB lost 8.9% and 12%, respectively, in the same time frame.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report