American Tower (AMT) Q3 AFFO Tops Estimates, Revenues Rise Y/Y

American Tower Corporation AMT reported third-quarter 2020 adjusted funds from operations (AFFO) per share of $2.23, beating the Zacks Consensus Estimate of $2.08. Further, the reported figure improved 15.5% year over year.

The company generated total revenues of $2.01 billion, which outpaced the Zacks Consensus Estimate of $1.97 billion. Moreover, the figure improved 3% year over year.

The company witnessed strong organic tenant billing growth. Moreover, robust revenue growth in the Africa and Europe property segments supported top-line improvement.

Quarter in Detail

Adjusted EBITDA in the reported quarter was $1.29 billion, up 5.6% from the prior-year quarter. Adjusted EBITDA margin was 64.5% in the third quarter of 2020. Operating income was $785.1 million, up 7.8% from the year-ago quarter’s figure.

During the third quarter, the company spent around $101 million to acquire 305 communication sites primarily in international markets.

Cash Flow and Liquidity

In the third quarter of 2020, American Tower generated $960 million of cash from operating activities, rising 2.5% year over year. Free cash flow during the period was $710 million, up 7.5% year over year.

At the end of the third quarter, the company had $6.7 billion of total liquidity. This comprised $1.6 billion in cash and cash equivalents, and availability of $5.1 billion under its revolving credit facilities (net of any outstanding letters of credit).

Property Segment

Quarterly revenues grossed $1.99 billion, up 3.4% year over year. Operating profit was $1.33 billion and operating profit margin was 67% during third-quarter 2020.

In the Property segment, revenues from the United States totaled $1,122 million, up 2.4% year over year. Further, total international revenues amounted to $885 million, up 4.8% year over year.

Within this, revenues from Asia totaled $305 million, declining 2.3 % year over year, while Latin America revenues totaled $301 million, down 9.1% year over year. Africa revenues grossed $220 million, up 48.4% year over year, while Europe revenues of $39 million improved 16.2% from the year-ago period.

Services Segment

Quarterly revenues totaled $25.3 million, down 20.9% year over year. Operating profit was $11 million and operating profit margin was 43% during the September-end quarter.

Outlook

For 2020, American Tower anticipates property revenues of $7,855-$7,915 million, reflecting a year-over-year improvement of 5.6% at the mid-point. Adjusted EBITDA is projected at $5,075-$5,125 million, indicating a mid-point increase of 7.5% from the prior year. Consolidated AFFO is estimated to be $3,720-$3,770 million, suggesting a year-over-year mid-point expansion of 6.4%.

Currently, American Tower carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

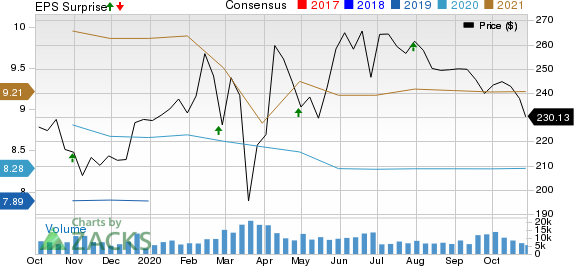

American Tower Corporation REIT Price, Consensus and EPS Surprise

American Tower Corporation REIT price-consensus-eps-surprise-chart | American Tower Corporation REIT Quote

We now look forward to the earnings releases of other REITs like Lexington Realty Trust LXP, National Storage Affiliates Trust NSA and Ventas, Inc. VTR. While Lexington Realty and National Storage Affiliates are slated to report third-quarter earnings on Nov 5, Ventas will release earnings on Nov 6.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation REIT (AMT) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Lexington Realty Trust (LXP) : Free Stock Analysis Report

National Storage Affiliates Trust (NSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.