Is Amerisafe, Inc. (AMSF) A Good Stock To Buy?

Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Amerisafe, Inc. (NASDAQ:AMSF) changed recently.

Hedge fund interest in Amerisafe, Inc. (NASDAQ:AMSF) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare AMSF to other stocks including Tortoise Energy Infrastructure Corporation (NYSE:TYG), Summit Hotel Properties Inc (NYSE:INN), and Veracyte Inc (NASDAQ:VCYT) to get a better sense of its popularity. Our calculations also showed that AMSF isn't among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a lot of signals shareholders can use to assess publicly traded companies. Some of the most useful signals are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top money managers can trounce the S&P 500 by a superb margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to take a look at the new hedge fund action surrounding Amerisafe, Inc. (NASDAQ:AMSF).

How are hedge funds trading Amerisafe, Inc. (NASDAQ:AMSF)?

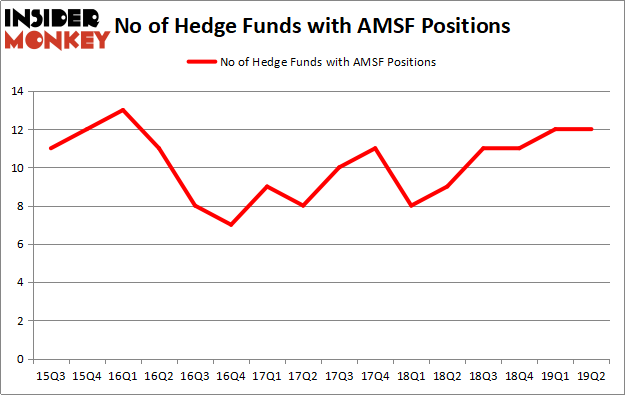

At the end of the second quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AMSF over the last 16 quarters. With the smart money's sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Amerisafe, Inc. (NASDAQ:AMSF) was held by Renaissance Technologies, which reported holding $9.8 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $7.7 million position. Other investors bullish on the company included Two Sigma Advisors, Fisher Asset Management, and Winton Capital Management.

Due to the fact that Amerisafe, Inc. (NASDAQ:AMSF) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of hedgies that decided to sell off their positions entirely heading into Q3. It's worth mentioning that Paul Tudor Jones's Tudor Investment Corp dropped the biggest stake of the 750 funds tracked by Insider Monkey, worth an estimated $0.6 million in stock, and Hoon Kim's Quantinno Capital was right behind this move, as the fund dropped about $0.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let's also examine hedge fund activity in other stocks similar to Amerisafe, Inc. (NASDAQ:AMSF). We will take a look at Tortoise Energy Infrastructure Corporation (NYSE:TYG), Summit Hotel Properties Inc (NYSE:INN), Veracyte Inc (NASDAQ:VCYT), and Bright Scholar Education Holdings Limited (NYSE:BEDU). This group of stocks' market values are closest to AMSF's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TYG,1,1073,-1 INN,12,12907,2 VCYT,24,145196,2 BEDU,9,72225,0 Average,11.5,57850,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $58 million. That figure was $28 million in AMSF's case. Veracyte Inc (NASDAQ:VCYT) is the most popular stock in this table. On the other hand Tortoise Energy Infrastructure Corporation (NYSE:TYG) is the least popular one with only 1 bullish hedge fund positions. Amerisafe, Inc. (NASDAQ:AMSF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on AMSF, though not to the same extent, as the stock returned 4.1% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019