Amgen Files for Once-Weekly Regimen for Myeloma Drug Kyprolis

Amgen Inc. AMGN announced that it has submitted a supplemental new drug application (sNDA) to the FDA to get an approval for a once-weekly dosing option with respect to its multiple myeloma drug, Kyprolis, in combination with dexamethasone (Kd).

The sNDA was based on positive data from the phase III study, A.R.R.O.W.

Interim data from the trial was presented at American Society of Clinical Oncology (ASCO) meeting this year in June. The outcomes showed that treatment with the Kyprolis once-weekly regimen at a higher dose of 70 mg/m2 led to superior overall response rates (ORR) than the twice weekly regimen. The ORR in patients treated with once-weekly Kd was 62.9% compared with 40.8% in case of those treated with the twice-weekly dosage. The safety profile was comparable between the two regimens.

The FDA will review the sNDA under the Oncology Center of Excellence Real-Time Oncology Review and Assessment Aid pilot programs, which will expediate the review process and ensure safe and effective treatments to patients as early as possible.

Kyprolis recorded sales of $263 million during the second quarter of 2018, up 25% year over year, mostly driven by increased demand and a robust uptake in the ex U.S. markets.

Kyprolis (twice weekly) is presently approved as a monotherapy as well as in combination with dexamethasone or with Celgene Corporations’ CELG Revlimid (lenalidomide) plus dexamethasone for relapsed/refractory multiple myeloma affected patients, having received one to three lines of therapy.

Notably, Amgen’s regulatory application in the United States to include the overall survival data from the ASPIRE study on the label of Kyprolis was granted an FDA approval this June. Earlier in January, the regulatory body gave a nod to Amgen’s regulatory application for inclusion of overall survival (OS) data from the head-to-head ENDEAVOR program on the label of Kyprolis.

Shares of Amgen have rallied 14.2% year to date against the industry’s decline of 4%.

Zacks Rank & Stocks to Consider

Amgen currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the pharma sector include Illumina, Inc. ILMN and Gilead Sciences, Inc. GILD, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Illumina’s earnings estimates have been raised 12.1% for 2018 and 10% for 2019 over the past 60 days. The stock has soared 57.9% so far this year.

Gilead Sciences’ earnings estimates have been moved 7.5% north for 2018 and 1.9% for 2019 over the past 60 days. The stock has gained 4.4% year to date.

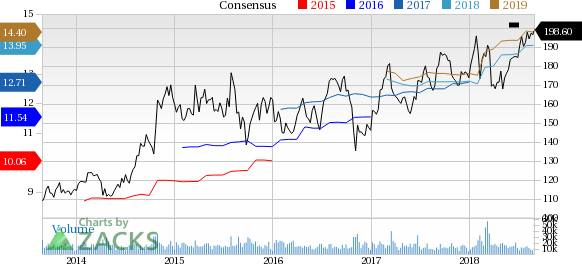

Amgen Inc. Price and Consensus

Amgen Inc. Price and Consensus | Amgen Inc. Quote

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Celgene Corporation (CELG) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research