Amgen's (AMGN) Q1 Earnings Top, Stock Down on IRS Tax Dispute

Amgen AMGN reported first-quarter 2022 earnings of $4.25 per share, which beat the Zacks Consensus Estimate of $4.22. Earnings rose 15% year over year, driven by higher revenues and lower share count

Total revenues of $6.24 billion beat the Zacks Consensus Estimate of $6.06 billion. Total revenues rose 6% year over year, driven by growth in product sales and higher Other Revenue.

Total product revenues rose 2% from the year-ago quarter to $5.73 billion (U.S.: $4.04 billion; ex-U.S.: $1.69 billion). Higher volumes were offset by lower selling prices of several drugs and currency headwinds. Volumes rose 9% in the quarter offset by a 7% lower net selling price. Foreign exchange movement hurt sales by 2% in the quarter. Favorable changes to estimated sales deductions benefited sales in the first quarter.

Sales of products like Otezla and Enbrel are historically lower in the first quarter relative to subsequent quarters in a year due to the impact of benefit plan changes, insurance re-verification and increased co-pay expenses as U.S. patients work through deductibles.

Other revenues of $507 million rose 64% year over year, aided by Amgen’s COVID-19 antibody manufacturing collaboration.

Performance of Key Drugs

Prolia revenues came in at $852 million, up 12% from the year-ago quarter, driven by double-digit volume growth as new and repeat patient volumes improved.

Xgeva delivered revenues of $502 million, up 7% from the year-ago quarter due to favorable changes to estimated sales deductions and higher prices, which offset the impact of lower volumes.

Evenity recorded sales of $170 million in the quarter, up 59% year over year driven by strong volume growth.

Kyprolis recorded sales of $287 million, up 14% year over year.

Repatha generated revenues of $329 million, up 15% year over year, as higher volume was partially offset by lower prices. Increased rebates to support broad Medicare Part D and commercial patient access in the United States and the inclusion of Repatha in China's National Reimbursement Drug List led to lower prices in the quarter.

Vectibix revenues came in at $201 million, up 5% year over year. Nplate sales rose 17% to $266 million. Blincyto sales increased 29% from the year-ago period to $138 million.

Aimovig recorded sales of $101 million in the quarter, up 53% year over year due to favorable changes to estimated sales deductions and higher net selling price, which offset the impact of lower volumes.

Sales of Otezla were $451 million in the quarter, down 5% due to lower net selling price and lower inventory levels, which offset the impact of higher volumes.

Amgen’s newly approved drug, Lumakras (sotorasib) recorded sales of $62 million in the quarter compared with $45 million in the previous quarter. The KRAS inhibitor was approved for the treatment of patients with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC) in the United States in May 2021 and the EU in January 2022.

Newly approved asthma drug, Tezspire (tezepelumab) recorded sales of $7 million in the quarter. Tezspire was approved in the United States in December 2021.

In biosimilars, sales of Kanjinti (Amgen’s biosimilar of Roche’s [RHHBY] Herceptin) were $96 million, down 40% year over year due to lower volumes and pricing as a result of increased competition.

Sales of Mvasi (biosimilar of Roche’s Avastin) were $244 million in the quarter, down 17% year over year due to declines in net selling price on increased competition that was partially offset by higher volume growth. Sales of Kanjinti and Mvasi are expected to continue to decline in the remaining quarters of 2022.

Amjevita (biosimilar of Humira) sales were $108 million in the quarter, up 2% year over year driven by volume growth, which was partially offset by lower net selling price due to increased competitive pressure.

Total sales of mature drugs like Enbrel, Parsabiv, Neupogen, Aranesp, Epogen and Neulasta declined 12% in the quarter due to an array of branded and generic competitors. Enbrel revenues of $862 million declined 7% year over year due to lower inventory and price.

Operating Margins Rise

The adjusted operating margin rose 360 basis points (bps) to 54.8%. Adjusted operating expenses rose 2% to $3.1 billion, driven by investments in the pipeline, product launches and digitalization costs. SG&A spending declined 1% to $1.2 billion. R&D expenses declined 1% year over year to $934 million.

2022 Outlook

Amgen maintained its previously issued revenue and adjusted earnings guidance in the range of $25.4 billion to $26.5 billion and $17.00 per share to $18.00 per share, respectively.

Amgen expects other revenues to be in the range of $1.4 billion to $1.7 billion in 2022. Adjusted cost of sales as a percent of product sales to be 15.5% to 16.5% in 2022. Adjusted R&D costs are expected to decrease in the range of 4% to 6% year over year in 2022. SG&A spend is expected to be flat year over year as a percentage of product sales. Amgen expects operating margin as a percentage of product sales to be roughly 50% in 2022.

The adjusted tax rate is expected to be in the range of 13.5%-14.5% while capital expenditures are expected to be approximately $950 million. The company expects to buy back shares in the range of $6.0 billion to $7.0 billion in 2022.

Tax Notice from IRS

The Internal Revenue Service (IRS) issued a deficiency notice to Amgen proposing some adjustments for the 2010-15 period earlier this month, primarily related to the allocation of profits between U.S. entities and Puerto Rico. The notice aims to increase Amgen’s taxable income for the 2013-2015 period that will result in an additional federal tax of approximately $5.1 billion-plus interest. The IRS additionally proposed penalties of approximately $2 billion for the period 2013 to 2015. The IRS is also currently auditing the 2016 to 2018 period

Amgen believes the adjustments and penalties proposed by IRS are without merit. Amgen looks to file a petition in US Tax Court.

Our Take

Amgen’s first-quarter results were decent as it beat estimates for both earnings and sales. Volume-driven growth of Repatha, Prolia, and Evenity drove the top line in the quarter. However, pricing pressure and increased competition continue to hurt sales of some drugs as well as biosimilar products. The pandemic hurt sales globally in the first two months of the quarter, However, demand patterns improved in the United States in March and April with the impact of the pandemic in the United States receding.

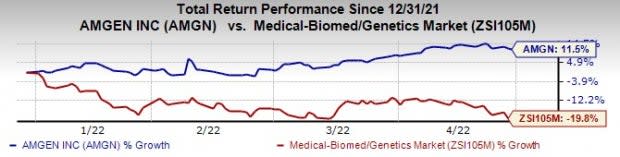

Despite the better-than-expected results, Amgen’s stock fell 6.2% in after-hours trading on Apr 27 due to the announcement about the litigation and dispute with the IRS. Amgen’s stock has risen 11.5% this year so far compared with a decrease of 19.8% for the industry.

Image Source: Zacks Investment Research

Zacks Rank and Stock to Consider

Amgen currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amgen Inc. Price, Consensus and EPS Surprise

Amgen Inc. price-consensus-eps-surprise-chart | Amgen Inc. Quote

Some better-ranked large drug/biotech stocks are Vertex Pharmaceuticals VRTX and Eli Lilly LLY, both with a Zacks Rank #2 (Buy).

Vertex Pharmaceuticals’ stock has risen 21.7% this year. Estimates for Vertex Pharmaceuticals’ 2022 earnings have gone up from $14.52 to $14.56 per share, while those for 2023 have increased from $15.31 to $15.35 per share over the past 30 days.

Vertex Pharmaceuticals’ earnings performance has been strong, with the company beating expectations in each of the last four quarters. Vertex Pharmaceuticals has a four-quarter earnings surprise of 10.01%, on average.

Lilly’s stock has risen 3.6% this year so far. Estimates for Lilly’s 2023 earnings have gone up from $9.78 to $9.91 per share over the past 30 days.

Lilly’s earnings performance has been rather weak with the company missing earnings expectations in each of the last four quarters. Lilly has a four-quarter negative earnings surprise of 3.92%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research