ANALYST: 'We Have Moved To A Second Phase Of The Rush For Yield'

The past few months have been characterized by major developments across global markets as traditional safe-haven investments that surged in the wake of the 2008 financial crisis have finally begun to lose their luster, and riskier assets have outperformed against everything else.

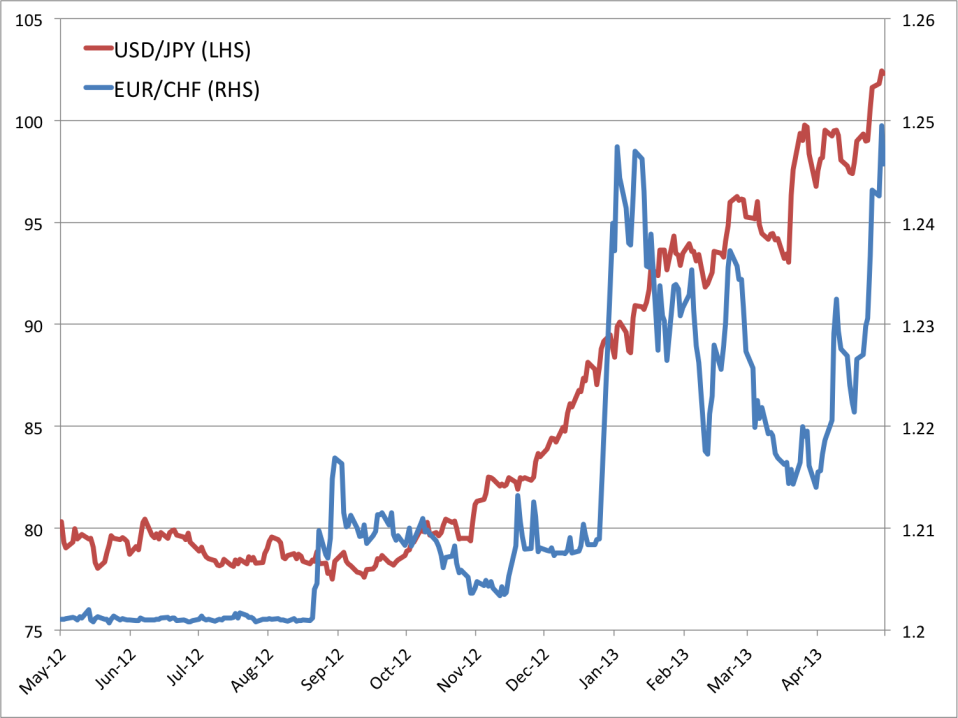

Markets saw this start to unfold first in the currency sphere, as investors started once again to exchange Swiss francs for euros and sell the Japanese yen (which rose to multi-year highs following the financial crisis) in force.

Business Insider/Matthew Boesler, data from Bloomberg

Meanwhile, global stocks have staged a strong rally – notably absent of any sort of significant correction – in recent months. The tone has been decidedly "risk-on," and government bond yields of "safe havens" like the U.S., Switzerland, and Japan initially rose accordingly as investors ditched the bonds in favor of riskier assets.

Then, in mid-March, investors began piling into safe haven bonds again as the Cypriot financial crisis reignited fears of a shockwave in Europe and prospects for global growth began to dim.

In the past several days, though, government bond yields in the U.S. and Japan have spiked, while Swiss yields have begun to rise again as well.

Business Insider/Matthew Boesler, data from Bloomberg

The upshot here is that as monetary stimulus in the world's developed economies has brought down government bond yields, investors have moved into riskier assets (like stocks) to obtain higher yields – and because the driving force behind this move has been so overwhelming, correlations across asset classes have increased as investors buy up anything and everything that provides decent interest income.

According to Société Générale foreign exchange strategist Sebastien Galy, the latest hammering of safe havens is a sign that the "second phase" in the rush for yield is being ushered in (emphasis added):

If you imagine central bankers sitting on the mountain and lighting fires to melt the iceberg of cash, the trickle of water turns to a torrent downstream. Ever heavier pebbles (e.g. High Yield) roll down at increasing speed so that correlations cross assets tend to increase. The lightest flows (e.g. Gold, FX vols) move ahead. The slope of the mountain or response of the economy to policy action is the steepest initially. At one point the lightest flows move far faster than an easing slope of the mountain, the divergence means a slowdown back into the flow of cash.

These incoherencies between asset prices and the economy is moving to heavier elements (back end of curves, USD vs world) leading to corrections. With Asia and Europe still slowing but the US still outperforming, the incoherence remains subdued. Nonetheless, we have moved to a second phase of the rush for yield. Glaciers are suffering the most (safe haven CHF, JPY, their curves) but the heavier boulders (high yield) are still stumbling down the market. The pattern of localized asset class correction is therefore set to remain, while we look for the heavy boulders coming down the stream and just hope most will end up as well mannered polished stones. Or my two cents on how to look at a complex system visually.

Those "heavy boulders" Galy refers to are the big U.S. and Japanese government bond markets. Société Générale's house view is that yields will rise substantially toward the end of 2013, but the key is whether the increase happens at a steady, benign pace, or whether it happens in a quick lurch upward – the latter of which would be significantly disruptive across global markets.

More From Business Insider