What Are Analysts Saying About Adelaide Brighton Limited's (ASX:ABC) Future?

As Adelaide Brighton Limited (ASX:ABC) released its earnings announcement on 30 June 2019, analysts seem fairly confident, with profits predicted to increase by 11% next year relative to the past 5-year average growth rate of -3.0%. With trailing-twelve-month net income at current levels of AU$185m, we should see this rise to AU$205m in 2020. I will provide a brief commentary around the figures and analyst expectations in the near term. For those interested in more of an analysis of the company, you can research its fundamentals here.

View our latest analysis for Adelaide Brighton

What can we expect from Adelaide Brighton in the longer term?

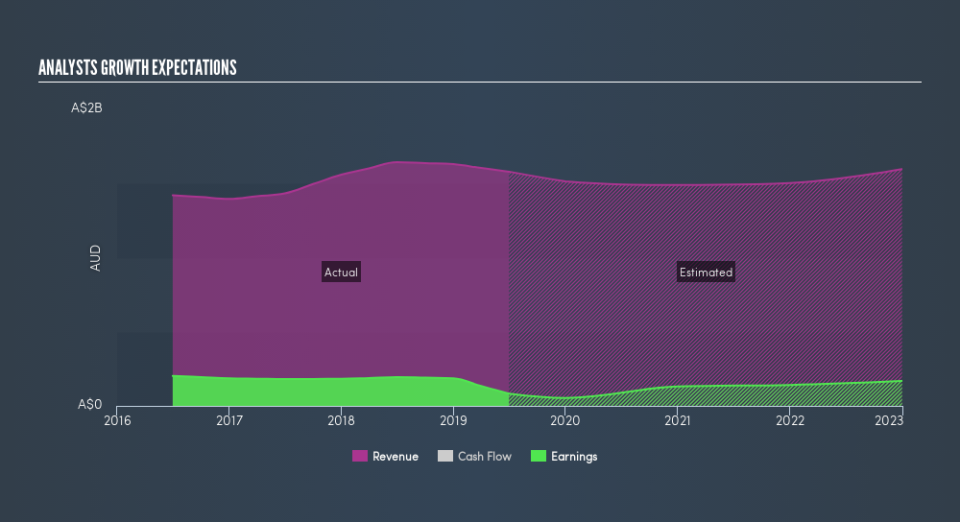

Longer term expectations from the 9 analysts covering ABC’s stock is one of positive sentiment. Since forecasting becomes more difficult further into the future, broker analysts generally project out to around three years. To reduce the year-on-year volatility of analyst earnings forecast, I've inserted a line of best fit through the expected earnings figures to determine the annual growth rate from the slope of the line.

From the current net income level of AU$185m and the final forecast of AU$346m by 2022, the annual rate of growth for ABC’s earnings is 26%. However, if we exclude extraordinary items from net income, we see that earnings is projected to fall over time, resulting in an EPS of A$0.22 in the final year of forecast compared to the current A$0.28 EPS today. In 2022, ABC's profit margin will have expanded from 11% to 22%.

Next Steps:

Future outlook is only one aspect when you're building an investment case for a stock. For Adelaide Brighton, I've put together three pertinent factors you should look at:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Valuation: What is Adelaide Brighton worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Adelaide Brighton is currently mispriced by the market.

Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Adelaide Brighton? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.