What Do Analysts Think About The Future Of Ocado Group plc’s (LON:OCDO) Business?

Ocado Group plc’s (LSE:OCDO) latest earnings announcement in December 2017 indicated that the company experienced a significant headwind with earnings falling by -91.67%. Investors may find it useful to understand how market analysts perceive Ocado Group’s earnings growth trajectory over the next few years and whether the future looks brighter. I will be using net income excluding extraordinary items in order to exclude one-off volatility which I am not interested in. See our latest analysis for Ocado Group

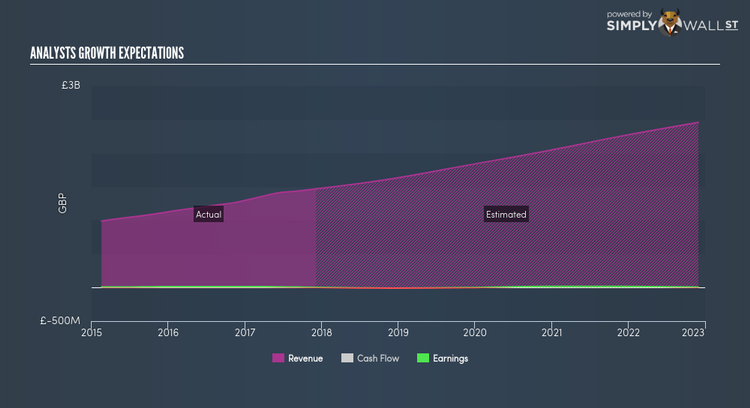

Market analysts’ prospects for the upcoming year seems pessimistic, with earnings turning into a loss in 2019. Though this loss doesn’t seem to last long as OCDO turns profitable again by 2021 with earnings expected to be -UK£8.35M.

Even though it is useful to understand the growth each year relative to today’s value, it may be more insightful to determine the rate at which the business is rising or falling every year, on average. The pro of this method is that it ignores near term flucuations and accounts for the overarching direction of Ocado Group’s earnings trajectory over time, which may be more relevant for long term investors. To compute this rate, I put a line of best fit through analyst consensus of forecasted earnings. The slope of this line is the rate of earnings growth, which in this case is 30.55%. This means, we can expect Ocado Group will grow its earnings by 30.55% every year for the next couple of years.

Next Steps:

For Ocado Group, I’ve compiled three pertinent factors you should further examine:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Future Earnings: How does OCDO’s growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of OCDO? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.