Analysts Think Thermo Fisher Will Continue Its Run

Is there still money to be made in Thermo Fisher Scientific Inc. (NYSE:TMO) stock? Analysts think so. Twenty-two of the professional investors assigned the company an average target price of $691. Thats nearly 18% higher than where the shares are currently trading.

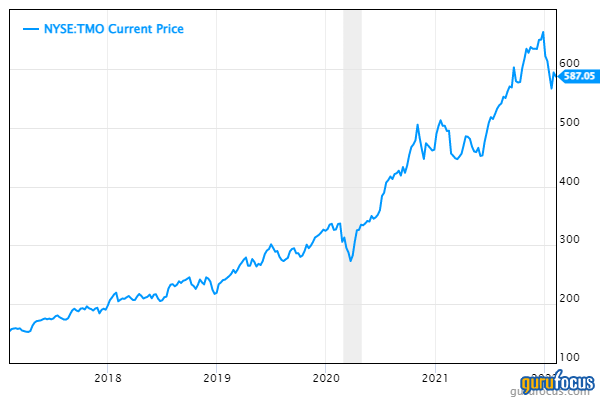

Shareholders of the Boston-area maker of scientific instrumentation, reagents and consumables have enjoyed a great run. The stock has climbed 16% in the past year. Longer-term investors have done even better, nearly tripling their investment since 2017.

Thermo Fisher has been front and center on the pandemic, generating more than 6% of its 2021 sales of $39 billion from the response to Covid-19. The company led the pack in addressing the virus with its real-time PCR-based test, which can diagnose the virus in less than three hours.

Half of the worldwide testing is done with the Thermo Fisher product and the company is the leading single-source supplier. Its test became even more common as the Omnicron variant soared late last year.

Caption: Thermo Fisher stock has been on a roll, and analysts think it will continue.

Thermo Fisher's prospects got even brighter in December when the company closed on the $17 billion acquisition of PPD, a Wilmington, North Carolina-based provider of clinical research and laboratory services that help customers to speed up innovation and boost drug development. In a news release, Thermo Fisher said PPD is expected to contribute $1.50 to its adjusted earnings per share in 2022.

Last month, Thermo Fisher finalized a $1.85 billion purchase of PeproTech Inc., a leading developer and manufacturer of recombinant proteins. As to future transactions, Chairman, President and CEO Marc Casper said there are plenty of opportunities out there and the company has the financial flexibility to do deals. However, any purchase must meet strict criteria, create shareholder value and add to its existing offerings.

We continue to successfully execute our disciplined capital deployment strategy, which is a combination of strategic M&A and returning capital to our shareholders, he told analysts during the year-end earnings call, pointing out that in 2021, the company invested $24 billion in mergers and acquisitions and completed 10 deals.

In 2021, Thermo Fishers adjusted earnings were $25.13 per share, up 28.5% from the year-ago period. It also topped the Zacks consensus estimate by 5.8%.

The company anticipates Covid-19 testing to register minimum sales of $1.75 billion in 2022, a billion-dollar increase from what it had expected earlier, and a major driver of Thermo Fisher's new year financial expectations. Overall sales are projected to be $42 billion, up from the companys most recent guidance and a number it thinks might be on the low side.

This article first appeared on GuruFocus.