Anatomy of Success: Chart Industries (GTLS)

The Zacks Ranking system is designed to help investors identify how a stock is expected to move over a one to three-month time frame.

Specifically, a company that receives the coveted #1 (Strong Buy) rating has a demonstrable history of outperforming the markets over that time period; only 5% of the Zacks Rank universe earns this rating. This methodology not only helps you discover these companies, but it also enables investors to stay hold the stock while it continues to appreciate in value.

Below is an example that shows investors how they could have realized a roughly 70% gain in 8 months by following the Zacks Rank.

Chart Industries Inc. (GTLS)

Headquartered in Ball Ground, Georgia, Chart Industries is an independent global manufacturer of highly engineered equipment servicing end market applications in Energy, Industry, Life Sciences, and Respiratory Healthcare. Their equipment is used in the production, storage, distribution, and end0use of atmospheric, hydrocarbon, and industrial gases. While its main focus is cryogenics, Chart Industries is organized into three operating segments: Energy & Chemicals; Distribution and Storage; and BioMedical.

GTLS first became a Strong Buy stock back on December 8, most likely due to overarching analyst bullishness as the company headed into its fourth quarter fiscal 2017 earnings report. Shares closed that trading day at $45.65.

Chart Industries performed well in Q4, with its top and both lines easily surpassing the Zacks Consensus Estimate. Full year 2017 revenue increased 15% from the prior year, and saw 5% organic growth. Chart order in 2017 grew 18% over 2016 (this number includes the Hudson acquisition); each of the company’s three segments had order growth over the prior year, with E&C 2017 orders totaling $243.6 million. As a result, Chart Industries expects 2018 guidance of 5-7% organic revenue growth and EPS in the range of $1.65 to $1.90 per share (including benefits from recently completed restructuring actions and of the Tax Cuts and Jobs Act).

The company was made a #1 stock again on June 22 after it reported impressive second quarter results. Earnings of 55 cents per share beat the Zacks Consensus, and revenues of $320 million surged 34% year-over-year and topped our consensus as well. Orders hit $360.3 million during the quarter, a 12% sequential increase and GTLS’s sixth consecutive quarter of sequential growth. Additionally, orders rose 43% year-over-year, with 6% organic growth. And, Chart Industries upped its full year revenue and EPS guidance. Seven months after becoming a Zacks Rank #1, shares of GTLS increased almost 40% to $63.50.

GTLS has been able to maintain its presence on the Strong Buy list ever since; its currently a #1 (Strong Buy) on the Zacks Rank. Shares currently trade at around $77.45, up about 70% from when the company was first made a Strong Buy stock.

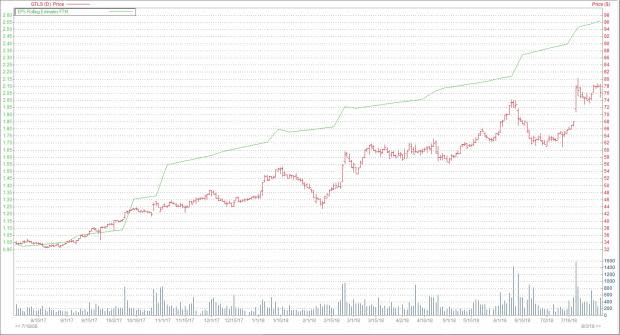

Here, this table shows the price performance of GTLS (in red), as well as the 12-month forward looking EPS estimate (in green) from the time the stock first earned a Zacks Rank #1 (Strong Buy). During this stretch, GTLS never moved lower than a Zacks Rank #3 (Hold).

By utilizing the Zacks Rank, investors are able to easily identify elite stocks that are best positioned to beat the market on a consistent basis, and how to hold those top stocks as they continue to grow.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research