Andreas Halvorsen Takes an Interest in GoHealth Following Its IPO

Viking Global's Andreas Halvorsen (Trades, Portfolio) disclosed earlier this week he established a 1.45% stake in GoHealth Inc. (NASDAQ:GOCO).

The guru's Connecticut-based firm selects stocks based on its understanding of the business' fundamentals and management team. It also considers cyclical and secular industry trends. Halvorsen was a former protege of Tiger Management's Julian Robertson (Trades, Portfolio).

According to GuruFocus Real-Time Picks, a Premium feature, Halvorsen invested in 4.56 million shares of the newly public Chicago-based company on July 16, allocating 0.47% of the equity portfolio to the position. The stock traded for an average price of $19.75 per share on the day of the transaction.

Founded in 2001, the company, which operates an online health insurance marketplace, has a $5.97 billion market cap; its shares were trading around $19.03 on Wednesday with a price-earnings ratio of 302.38, a price-book ratio of 18.51 and a price-sales ratio of 11.52. Since its debut on July 15, GoHealth's stock has fallen around 2%.

On July 14, GoHealth announced it was offering 43.5 million shares of its class A common stock for $21 per share and gave underwriters a 30-day option to purchase up to an additional 6.5 million shares. The offering closed on July 17.

Then, on July 22, the company revealed it has opened four additional virtual sales centers and plans to hire over 1,000 individuals as it prepares for the 2020 annual enrollment period. GoHealth, which uses technology, data science and deep industry expertise to match customers with the health care policy and carrier that is best for them, has been transitioning its agents to work from home amid the ongoing coronavirus pandemic. The new centers, which are located in Tampa, Florida, Columbus, Ohio, Phoenix and Dallas, were selected due to large availability of licensed sales talent as well as the company's ability to work closely with state regulators and their vendors to expedite the licensing process for new agents and resolve prior Covid-related delays.

"We now have 90% of the licensed internal Medicare agents that we had targeted for 2020," Chief Human Resources Officer Mark Monitello said in a press release. "GoHealth's telesales agents have a track record of providing objective expertise for newly eligible Medicare consumers as well as those looking to compare the improved benefits of our enhanced carrier programs. And at a time when seniors are increasingly concerned about their health and wellbeing, our virtual, licensed agents help educate them about their Medicare plan options from the safety of their own home."

GuruFocus rated GoHealth's financial strength 5 out of 10 on the back of poor interest coverage and a cash-debt ratio that ranks lower than a majority of competitors.

The company's profitability fared even worse with a 4 out of 10 rating. Its margins and returns on equity and assets are also underperforming industry peers. The return on capital, however, outperforms 80% of the industry.

Currently, Halvorsen is the only guru invested in the stock.

Portfolio composition

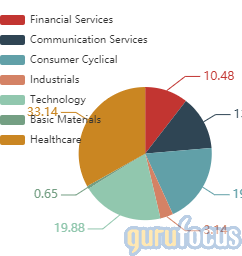

More than 30% of Halvorsen's $19.21 billion equity portfolio, which was composed of 64 stocks as of the end of the first quarter, is invested in the health care sector. He has smaller holdings in the technology (19.88%) and consumer cyclical (19.53%) spaces as well.

Other insurance companies the guru's firm was invested in as of March 31 were Progressive Corp. (NYSE:PGR), Chubb Ltd. (NYSE:CB), Arthur J. Gallagher & Co. (NYSE:AJG), Aon PLC (NYSE:AON), Assurant Inc. (NYSE:AIZ), American International Group Inc. (NYSE:AIG), Equitable Holdings Inc. (NYSE:EQH) and MetLife Inc. (NYSE:MET).

Disclosure: No positions.

Read more here:

Seth Klarman Strengthens Viasat Connection

The Top 5 Trades of the Eaton Vance Worldwide Health Sciences Fund

Steven Cohen Homes in on Otonomy

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.