AngioDynamics (ANGO) Q1 Earnings and Revenues Top Estimates

AngioDynamics, Inc. ANGO reported first-quarter fiscal 2021 adjusted earnings per share (EPS) of 2 cents against the Zacks Consensus Estimate of a loss per share of 6 cents. The company saw a decline of 75% in its bottomline from the year-ago quarter.

Revenue Details

For the fiscal first quarter, revenues totaled $70.2 million, which beat the Zacks Consensus Estimate by 6.9%. Further, the top line rose 6.3% on a year-over-year basis.

Geographical Analysis

In the quarter under review, U.S. net revenues totaled $54.1 million, up 2.2% year over year.

International revenues came in at $16.1 million, up 22.9% from the year-ago quarter.

Segmental Analysis

Vascular Interventions and Therapies (VIT) Business

VIT revenues in the fiscal first quarter grossed $29.9 million, up 3.3% from the year-ago quarter. This was driven by 46% growth in AngioVac sales, partially offset by a decline in sales of Venous products due to a drop in elective procedure volumes.

Vascular Access (VA) Business

Revenues at this segment amounted to $28.1 million, up 21.4% on a year-over-year basis.

Oncology/Surgery Business

Revenues at the Oncology segment declined 12.3% year over year to $12.3 million. Per management,growth in microwave ablation and U.S. NanoKnife probe sales was more than offset by lower sales in overseas markets.

Margin Analysis

In the quarter under review, gross profit totaled $35.8 million, down 6.4% from the year-ago quarter number. Moreover, gross margin was 50.9%, down 693 basis points (bps).

Adjusted operating profit came in at $18.2 million, down 22.5% year over year. Adjusted operating margin came at 25.9%, highlighting a contraction of 962 bps.

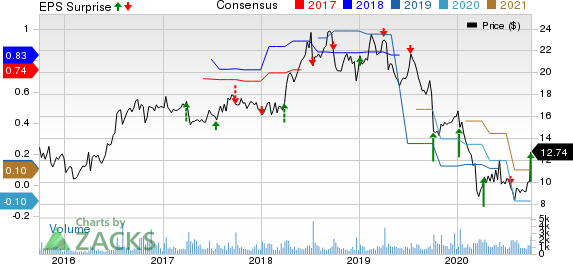

AngioDynamics, Inc. Price, Consensus and EPS Surprise

AngioDynamics, Inc. price-consensus-eps-surprise-chart | AngioDynamics, Inc. Quote

2021 Guidance

Revenues are expected in the range of $278-$284 million. The Zacks Consensus estimate for the same is pegged at $274.1 million.

Adjusted EPS is estimated between a breakeven and 5 cents. The Zacks Consensus estimate for the metric is pegged at a loss of 11 cents.

Cash Position

The company exited the fiscal first quarter with $47.9 million of cash and cash equivalents, compared with $54.4 million at the end of the fourth quarter of fiscal 2020. Net cash used in operating activities came in at $5.4 million versus $6.5 million a year ago.

Summary

AngioDynamics exited the first quarter of fiscal 2021 on a strong note. Around the end of the quarter, the company launched the Auryon Atherectomy System. It saw revenue growth in two of its operating segments.The company witnessed solid performance at its technology platforms, including strong sales growth in the AngioVac platform and more than $1 million in sales in its Auryon platform.

However, the company witnessed revenue decline in the Oncology segment in the quarter under review. Also, contraction in both margins is worrisome.

Zacks Rank & Key Picks

Currently, AngioDynamics carries a Zacks Rank #3 (Hold).

The Zacks Consensus Estimate for Quidel Corporation’s QDEL third-quarter 2020 revenues is pegged at $401 million, indicating a 217% improvement from the year-ago figure. The consensus mark for the bottom line is pegged at $4.12 per share, indicating a 488.6% surge from the year-ago figure. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BioRad Laboratories, Inc.’s BIO third-quarter 2020 EPS is pegged at $1.85 per share, suggesting a 14.9% improvement from the year-ago period. The same for revenues is pegged at $565.3 million, calling fora 0.8% increase from the year-earlier figure. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Brainsway Ltd.’s BWAY bottom line for third-quarter 2020 is pegged at a loss of 6 cents per share, indicating a 50% improvement from the year-ago reported loss. The company currently carries a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Quidel Corporation (QDEL) : Free Stock Analysis Report

BioRad Laboratories, Inc. (BIO) : Free Stock Analysis Report

Brainsway Ltd. Sponsored ADR (BWAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research