Announcing: Hailiang Education Group (NASDAQ:HLG) Stock Soared An Exciting 749% In The Last Three Years

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won't get it right every time, but when you do, the returns can be truly splendid. One bright shining star stock has been Hailiang Education Group Inc. (NASDAQ:HLG), which is 749% higher than three years ago. It's also up 11% in about a month.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Hailiang Education Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

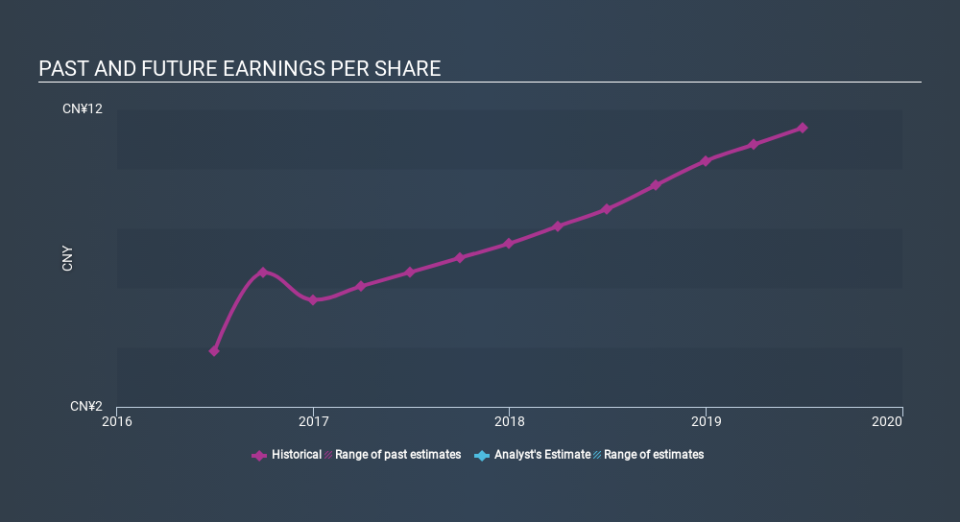

Hailiang Education Group was able to grow its EPS at 43% per year over three years, sending the share price higher. In comparison, the 104% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 45.06.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Hailiang Education Group's key metrics by checking this interactive graph of Hailiang Education Group's earnings, revenue and cash flow.

A Different Perspective

Pleasingly, Hailiang Education Group's total shareholder return last year was 113%. So this year's TSR was actually better than the three-year TSR (annualized) of 104%. Given the track record of solid returns over varying time frames, it might be worth putting Hailiang Education Group on your watchlist. Before forming an opinion on Hailiang Education Group you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.