Is ANSYS, Inc.'s (NASDAQ:ANSS) CEO Being Overpaid?

Ajei Gopal has been the CEO of ANSYS, Inc. (NASDAQ:ANSS) since 2017. This analysis aims first to contrast CEO compensation with other large companies. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for ANSYS

How Does Ajei Gopal's Compensation Compare With Similar Sized Companies?

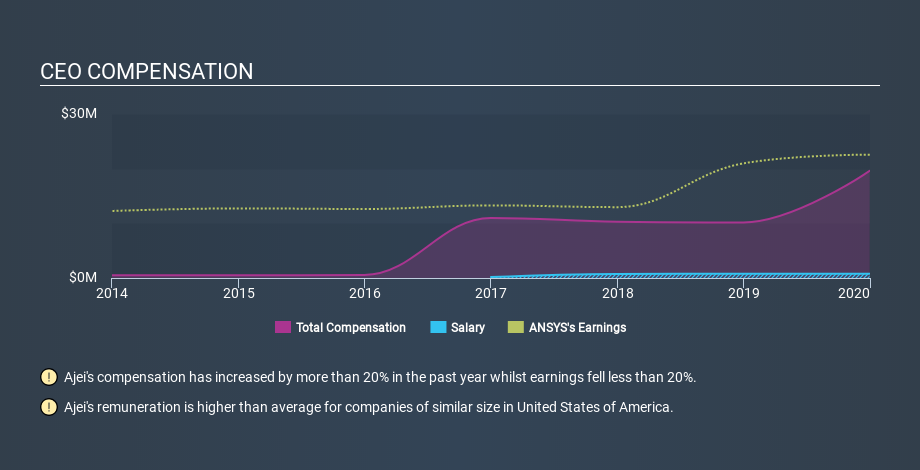

According to our data, ANSYS, Inc. has a market capitalization of US$23b, and paid its CEO total annual compensation worth US$20m over the year to December 2019. Notably, that's an increase of 93% over the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$794k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. We looked at a group of companies with market capitalizations over US$8.0b and the median CEO total compensation was US$12m. Once you start looking at very large companies, you need to take a broader range, because there simply aren't that many of them.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where ANSYS stands. On a sector level, around 13% of total compensation represents salary and 87% is other remuneration. Investors will find it intriguing that ANSYS paid a marginal salary to Ajei Gopal, over the past year, focusing on non-salary compensation instead.

Thus we can conclude that Ajei Gopal receives more in total compensation than the median of a group of large companies in the same market as ANSYS, Inc.. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business. You can see, below, how CEO compensation at ANSYS has changed over time.

Is ANSYS, Inc. Growing?

ANSYS, Inc. has seen earnings per share (EPS) move positively by an average of 21% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 13%.

This demonstrates that the company has been improving recently. A good result. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Shareholders might be interested in this free visualization of analyst forecasts.

Has ANSYS, Inc. Been A Good Investment?

Most shareholders would probably be pleased with ANSYS, Inc. for providing a total return of 113% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We examined the amount ANSYS, Inc. pays its CEO, and compared it to the amount paid by other large companies. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. On top of that, in the same period, returns to shareholders have been great. So, considering this good performance, the CEO compensation may be quite appropriate. Shareholders may want to check for free if ANSYS insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.