Antero Midstream (AM) Tops on Q1 Earnings, Lowers '23 Capex View

Antero Midstream Corporation AM shares have gained 7% since it reported strong first-quarter 2023 results on Apr 26.

The midstream energy player reported first-quarter 2023 adjusted earnings per share of 21 cents, beating the Zacks Consensus Estimate of 19 cents. The bottom line improved from the year-ago quarter’s earnings of 19 cents.

Total quarterly revenues of $259.5 million surpassed the Zacks Consensus Estimate of $250 million. The top line increased from $218.5 million in the year-ago quarter.

Strong quarterly results were primarily driven by higher freshwater delivery volumes and increased average freshwater distribution fees.

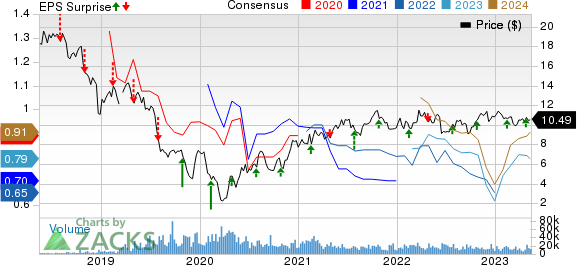

Antero Midstream Corporation Price, Consensus and EPS Surprise

Antero Midstream Corporation price-consensus-eps-surprise-chart | Antero Midstream Corporation Quote

Operational Performance

In first-quarter 2023, average daily compression volumes were 3,137 million cubic feet (MMcf/d), up from the year-ago level of 2,816 MMcf/d. On a per-Mcf basis, the compression fee was 21 cents, in line with the prior-year quarter.

In the reported quarter, high-pressure gathering volumes totaled 2,801 MMcf/d, down from the year-ago period’s 2,878 MMcf/d. On a per-Mcf basis, the average gathering high-pressure fee was 21 cents, in line with the prior-year level.

Low-pressure gathering volumes averaged 3,171 MMcf/d, up from the first-quarter 2022 figure of 2,930 MMcf/d. On a per-Mcf basis, the average gathering low-pressure fee was 35 cents, higher than the prior-year level of 34 cents.

Freshwater delivery volumes were at 123 MBbls/d, up 41% from the prior-year level of 87 MBbls/d. On a per-barrel basis, the average freshwater distribution fee was $4.21 in the reported quarter, up from $4.07.

Operating Expenses

In first-quarter 2023, direct operating expenses of Antero Midstream were $57.9 million, up from $42 million a year ago.

Antero Midstream’s total operating expenses in the quarter were $111.1 million, increasing from the first-quarter 2022 levels of $89.3 million.

Balance Sheet

As of Mar 31, Antero Midstream had no cash and cash equivalents. As of the same date, the company had $3,331.3 million of long-term debt.

Outlook

For 2023, Antero Midstream expects a net income of $355-$395 million, indicating an increase from the $326.2 million reported in 2022.

The company expects an adjusted net income of $410-$450 million and an adjusted EBITDA of $950-$990 million for the year. The midstream operator anticipates a free cash flow before dividends of $550-$590 million.

The Zacks Rank #3 (Hold) company disclosed a capital budget of $180-$200 million for 2023, indicating a decline from the previously mentioned $195-$215 million. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Glimpse of Other Midstream Companies’ Q1 Earnings

Kinder Morgan, Inc. KMI reported first-quarter 2023 adjusted earnings per share of 30 cents, beating the Zacks Consensus Estimate by a penny. Better-than-expected quarterly earnings were primarily aided by higher gathering and transport volumes.

For 2023, KMI projects a net income attributable to the midstream player of $2.5 billion. For this year, it expects a dividend of $1.13 per share, suggesting an increase of 2% from the prior-year reported figure.

Crestwood Equity Partners LP CEQP reported first-quarter adjusted earnings of 15 cents per unit, in line with the Zacks Consensus Estimate. The bottom line reversed from the year-ago quarter’s loss of 4 cents per unit.

For 2023, Crestwood expects adjusted EBITDA of $780-$860 million, suggesting an improvement from the $762.1 million reported in 2022. The partnership expects a free cash flow after paying distributions of $10-$90 million.

Enbridge Inc. ENB recorded first-quarter adjusted earnings per share of 63 cents, beating the Zacks Consensus Estimate of 62 cents. The bottom line declined from the year-ago quarter’s 66 cents.

For 2023, Enbridge projects EBITDA of C$15.9-C$16.5 billion, indicating an increase from the C$12 billion reported in 2022. The company expects a distributable cash flow per share of C$5.25-C$5.65 for the year, the mid-point of which suggests an increase from the C$5.42 reported in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Antero Midstream Corporation (AM) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Crestwood Equity Partners LP (CEQP) : Free Stock Analysis Report