Anthem (ANTM) Q4 Earnings Miss Estimates, Revenues Up Y/Y

Anthem, Inc. ANTM delivered fourth-quarter 2020 earnings of $2.54 per share, which missed the Zacks Consensus Estimate by 1.2%. Further, the bottom line plunged 34.5% year over year due to elevated costs.

Nevertheless, Anthem’s operating revenues of $31.5 billion outpaced the Zacks Consensus Estimate by 2.3%. Moreover, the top line improved 16.2% year over year owing to increased premium revenues attributable to the company’s strong Medicaid and Medicare businesses. Pharmacy product revenues stemming from the launch of IngenioRx and the return of the health insurance tax in 2020 have also contributed to the top-line growth.

Quarterly Operational Update

Anthem’s benefit expense ratio of 88.9% contracted 10 basis points (bps) from the prior-year quarter primarily driven by lower non-COVID healthcare utilization due to the pandemic. However, the decrease was partially offset by higher testing and treatment costs related to the pandemic.

SG&A expense ratio of 13.7% expanded 80 bps from the year-ago quarter due to return of the health insurance tax in 2020 and higher spend while pursuing growth initiatives. Nevertheless, rise in operating revenues have partially benefited the metric.

Total expenses of the company increased 18.6% year over year to $31.2 billion due to higher benefit expense, cost of products sold, selling, general and administrative expenses, interest expense, and amortization of other intangible assets.

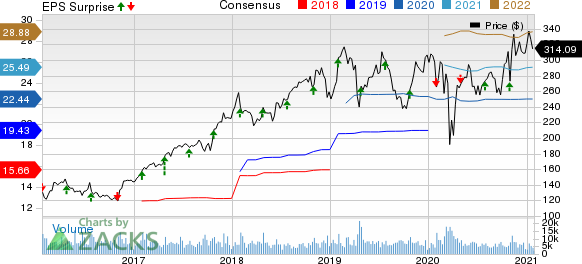

Anthem, Inc. Price, Consensus and EPS Surprise

Anthem, Inc. price-consensus-eps-surprise-chart | Anthem, Inc. Quote

Segmental Results

Commercial & Specialty Business

Operating revenues of $9.2 billion in the fourth quarter were down 1.1% year over year.

The segment reported an operating gain of $123 million, which declined 76.7% year over year.

Operating margin was 1.3%, which contracted 430 bps from the year-ago quarter’s figure.

Government Business

Operating revenues were $18.8 billion, up 15.7% from the prior-year quarter.

Operating gain was $169 million, down 71.2% year over year due to expenses associated with the COVID-19 pandemic, drifting of pharmacy earnings to the IngenioRx segment and, higher spend to assist growth.

Operating margin was 0.9%, down 270 bps year over year.

IngenioRx

While operating gain from the segment was $363 million in fourth-quarter 2020, operating margin for the same came in at 6.2%.

Other

Operating revenues were $1.8 billion, which soared 190.4% from the prior-year quarter.

The Other segment’s operating loss of $50 million compared unfavorably with the year-earlier quarterly loss of $15 million.

Financial Update

As of Dec 31, 2020, Anthem’s cash and cash equivalents totaled $5.7 billion, up 16.3% from the level at 2019 end.

As of Dec 31, 2020, its long-term debt less current portion increased 8.7% to $19.3 billion from the level at 2019 end.

Operating cash outflow was $3.8 billion for fourth-quarter 2020.

Capital Deployment

During the fourth quarter, Anthem bought back shares worth $1.4 billion. As of Dec 31, 2020, the company had shares worth $1.1 billion remaining under its share buyback authorization.

Moreover, the company paid out a quarterly dividend of 95 cents per share, adding up to a distribution of cash worth $234 million.

The company announced a dividend of $1.13 per share on Jan 26, 2021 for first-quarter 2021, which represents a hike of nearly 19% from the prior payout. The new dividend will be payable on Mar 25, 2021 to its shareholders of record as of Mar 10.

Full-Year Update

For 2020, operating revenues totaled $120.8 billion, up 17.1% year over year. Full-year earnings per share was $22.48, which improved 15.6% year over year.

As of Dec 31, 2020, Medical enrollment increased 4.7% year over year to 42.9 million members. This upside was primarily driven by higher total risk enrollment, fee-based enrollment, Government Business enrollment and Commercial & Specialty Business enrollment.

Operating cash flow of the year surged 76.3% year over year to $10.7 billion. During 2020, the company repurchased shares worth $2.7 billion.

Guidance for 2021

Following the company’s fourth-quarter results, Anthem issued its outlook for 2021.

Adjusted net income for the current year is projected to be more than $24.50 per share.

Medical membership is forecasted in the range of 44.1 million to 44.7 million.

Operating revenues are anticipated around $135.1 billion encompassing premium revenues of $114.5-$115.5 billion.

Also, the company estimates operating cash flow of more than $5.7 billion.

The company predicts the benefit expense ratio at 88%, plus or minus 50 bps.

For the current year, investment income is expected to be $940 million.

Anthem envisions its SG&A ratio in the range of 10.8% plus or minus 50 bps.

Zacks Rank

Anthem currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the medical sector players that reported fourth-quarter results so far, the bottom line of UnitedHealth Group Incorporated UNH beat the Zacks Consensus Estimate.

Upcoming Releases

Here are some companies worth considering from the healthcare sector as our model shows that these have the right combination of elements to beat on earnings this reporting cycle:

Tenet Healthcare Corporation THC has an Earnings ESP of +7.10% and a Zacks Rank #1, currently.

Teladoc Health, Inc. TDOC has an Earnings ESP of +31.58% and a Zacks Rank of 2, presently.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

Teladoc Health, Inc. (TDOC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research