Anthem's (ANTM) Q1 Earnings Beat Estimates, Increase Y/Y

Anthem, Inc. ANTM delivered first-quarter 2021 earnings of $7.01 per share, which beat the Zacks Consensus Estimate of $6.86 by 2.2%.

Further, the bottom line increased 8.2% year over year on the back of better revenues.

Nevertheless, Anthem’s operating revenues of $32.1 billion missed the Zacks Consensus Estimate by 3.4%. However, the top line improved 9% year over year owing to increased premium revenues, attributable to the company’s strong Medicaid and Medicare businesses. Pharmacy product revenues recognized from the launch of IngenioRx also contributed to the same.

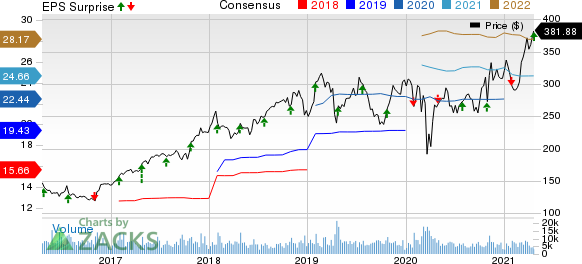

Anthem, Inc. Price, Consensus and EPS Surprise

Anthem, Inc. price-consensus-eps-surprise-chart | Anthem, Inc. Quote

Quarterly Operational Update

Anthem’s benefit expense ratio of 85.6% expanded 140 basis points (bps) from the prior-year quarter, primarily due to lower non-COVID healthcare utilization amid the pandemic as well as the repeal of the health insurance tax in 2021. However, this was partially offset by non-COVID healthcare utilization, etc.

SG&A expense ratio of 12.2% contracted 60 bps from the year-ago quarter on the back of repealing the health insurance tax in 2021 and better operating revenues.

Total expenses of the company increased 9.7% year over year to $30.2 billion due to higher benefit expense, cost of products sold, and selling, general and administrative expenses.

Segmental Results

Commercial & Specialty Business

Operating revenues of $9.5 billion in the first quarter were up 1.4% year over year.

The segment reported an operating gain of $1.268 billion, which declined 10.7% year over year.

Operating margin was 13.4%, which contracted 180 bps from the year-ago quarter’s figure.

Government Business

Operating revenues were $19.2 billion, up 10.4% from the prior-year quarter.

Operating gain was $478 million, up 16.3% year over year, driven by a rise in Medicaid membership and the effect of one less calendar day. However, the same was partly offset by expenses related to COVID-19, net of reduced non-COVID healthcare utilization, experience-rated rebates in the Medicaid business and lower-risk revenues.

Operating margin was 2.5%, up 10 bps year over year.

IngenioRx

While operating gain from the segment was $407 million in first-quarter 2021, operating margin for the same came in at 6.7%. Operating gain in the segment rose 16.6% year over year on the back of an out-of-period adjustment and growth in integrated medical and pharmacy membership.

Other

Operating revenues were $2.3 billion, which soared 130.8% from the prior-year quarter.

The Other segment’s gain of $8 million compared unfavorably with the year-earlier quarterly gain of $14 million.

Financial Update

As of Mar 31, 2021, Anthem’s cash and cash equivalents totaled $9.3 billion, up 62.4% from the level at 2020 end.

As of Mar 31, 2021, its long-term debt less current portion increased 16.5% to $22.5 billion from the level at 2020 end.

Operating cash outflow was $2.5 billion for first-quarter 2021.

Capital Deployment

During the first quarter, Anthem bought back shares worth $1.4 billion. As of Mar 31, 2021, the company had shares worth $5.6 billion remaining under its share buyback authorization.

Moreover, the company paid out a quarterly dividend of $1.13 per share, adding up to a distribution of cash worth $277 million.

The company announced a dividend of $1.13 per share on Apr 20, 2021 for second-quarter 2021. The new dividend will be payable Jun 25, 2021 to its shareholders of record as of Jun 10, 2021.

Guidance for 2021

Following the company’s first-quarter results, Anthem raised its full-year outlook.

Adjusted net income for the current year is projected to be more than $25.10 per share.

Medical membership is still forecast in the range of 44.1-44.7 million.

Operating revenues are anticipated at $135.1 billion including premium revenues of $114.5-$115.5 billion.

Also, the company still estimates an operating cash flow of more than $5.7 billion.

The company predicts the benefit expense ratio at 88%, plus or minus 50 bps.

For the current year, investment income is expected to be $970 million.

Anthem envisions its SG&A ratio in the range of 10.8%, plus or minus 50 bps.

Zacks Rank

Anthem currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the medical sector players that have reported first-quarter results so far, the bottom-line results of UnitedHealth Group Incorporated UNH and Tenet Healthcare Corporation THC beat the respective Zacks Consensus Estimate.

Upcoming Releases

Here is a company worth considering from the healthcare sector as our model shows that these have the right combination of elements to beat on earnings this reporting cycle:

bluebird bio, Inc. BLUE has an Earnings ESP of +4.56% and a Zacks Rank #3, currently.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

AccessZacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research