Here's What I'm Watching When Wells Fargo Reports Earnings

Earnings season is upon us, and the big U.S. banks are among the first companies set to report. One bank that I'm keeping a particularly close eye on as we await its fourth-quarter earnings is Wells Fargo (NYSE: WFC), which reports on Friday, Jan. 12.

You're probably familiar with Wells Fargo's infamous fake-accounts scandal, which has been weighing on the company's growth, profitability, and efficiency lately. Will the bank begin to successfully move on from the scandal, or are the days of Wells Fargo as the most profitable and efficient U.S. banking giant in the past?

Image source: Getty Images.

Will its revenue, deposit, and loan growth be in line with those of its peers?

One of the most alarming things that can happen to a bank, or any other company for that matter, is to significantly underperform its peer group. This can be an indication that the bank is losing market share or its competitive advantages.

In the third quarter of 2017, the largest U.S. banks posted revenue growth across the board, except for Wells Fargo, which saw revenue drop by 2% year over year. Earnings were up across the board as well, except for Wells Fargo.

I'm not as concerned about hitting a certain metric, such as 5% revenue growth, as I am that Wells Fargo's growth is in line with its peer group. If other big banks' revenue jumps by, say, 4%, I want to see a similar move in Wells' numbers. The same goes for other areas, such as deposit and loan growth.

ROE, ROA, and efficiency

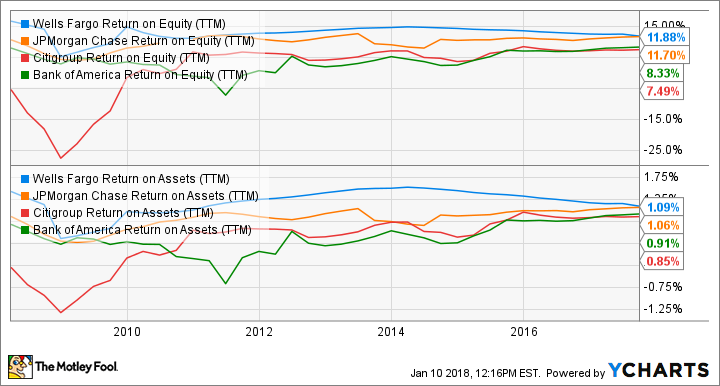

In the 10 or so years that I've been following bank stocks professionally, Wells Fargo has been the most profitable of the "big four" U.S. banks without fail, as you can see below.

WFC return on equity (TTM) data by YCharts.

This came to an abrupt end in the wake of the bank's numerous recent scandals. Its return on assets has fallen from 1.17% to 0.94% over the past year, and its return on equity has fallen below the key 10% industry benchmark for the first time in several years.

The same can be said about its efficiency ratio, which has historically been among the highest of its peer group. Well, over the past year, Wells Fargo's efficiency has deteriorated from 59.4% (lower is better) to 65.5%.

Some of this was undoubtedly due to the bank's increased legal expenses, which are a temporary problem. So, in the upcoming earnings report, as well as over the next several quarters, I'll be curious to see how much of the profitability drop was temporary and how much (if any) is going to be permanent.

Net interest margins

Generally speaking, when the Federal Reserve raises rates, it translates into better net interest margins, or profit margins, for banks. In simple terms, the rates banks charge on loans tend to grow faster than the rates they pay out on deposits, resulting in a growing spread between the two.

When Wells Fargo issued its third-quarter earnings report, the lack of margin expansion was one of the most concerning things I saw, given the recent Fed rate hikes. Over the past four quarters, net interest margins for Bank of America and JPMorgan Chase have risen by 13 and 11 basis points, respectively, while Wells Fargo's margins haven't changed at all.

So, when the bank reports its year-end earnings, I'll be looking to see if the bank's margins are finally showing signs of growth.

What impact will tax reform have on the bank?

In the third quarter, before we had any idea what tax reform would look like or whether it would even get done at all, Wells Fargo operated at a 31.2% effective tax rate (combined federal and state), which is one of the highest among its peer group. So, it seems reasonable to expect that the new 21% corporate tax rate could benefit Wells Fargo going forward.

In the fourth-quarter earnings report, and the conference call that follows, we should get some color as to what impact the bank's management expects from tax reform, both in an immediate sense and on an ongoing basis. It has already announced plans to boost its minimum wage to $15 per hour and that it will increase its charitable giving by about 40%. While these are certainly noble causes, it hasn't yet given any specifics about how its bottom line could also be helped.

Just to give you an idea of what you could expect, analysis by Goldman Sachs concluded that the seven largest U.S. banks (excluding Goldman) could see earnings increase by an average of 14%, and Wells Fargo would get the biggest boost. According to Goldman's analysis, Wells Fargo's earnings could jump by 18%, mainly because virtually all of its profits are domestic.

The effects of the scandal: Permanent or temporary?

As you can see, aside from the point about tax reform, what I'll be watching centers around whether Wells Fargo is successfully overcoming the effects of its fake-accounts scandal and other 2017 issues. If the bank's revenue growth picks up, interest margins start to improve, and it starts to look like the most profitable and efficient of the big four U.S. banks once again, Wells Fargo's current stock price could be a major bargain.

On the other hand, if the scandal's effects linger for a long time, or it turns out that Wells Fargo has permanently lost its key competitive advantage of cross-selling products to its customers, which helped it to be so profitable and efficient, the company could continue to be a laggard in the banking sector for some time.

More From The Motley Fool

Matthew Frankel owns shares of Bank of America. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.