What's in Store for Castlight (CSLT) This Earnings Season?

Castlight Health, Inc. CSLT is slated to report first-quarter 2018 results on May 10.

Notably, the company has beaten the Zacks Consensus Estimate in the trailing four quarters, with an average positive surprise of 21.79%.

The company reported fourth-quarter 2017 loss of 4 cents per share, in line with the Zacks Consensus Estimate and narrower than year-ago quarter figure of 5 cents per share.

Revenues surged 23.8% year over year to $37 million, which outpaced the Zacks Consensus Estimate of $36 million.

Guidance & Estimates

For 2018, the company forecasts revenues between $150 million and $155 million. Management expects the first half contribution to revenues to be in the high 40% range with the remainder in the second half of the year.

Non-GAAP operating loss is expected in the range of $15-$20 million. Non-GAAP loss is expected between 11 cents and 15 cents per share.

Castlight anticipates first-quarter 2018 revenues to decline by about $1 million sequentially. Moreover, gross margin is expected to contract sequentially as company’s investments increases. Operating loss is projected to increase due to revenue seasonality.

Management expects to report break-even in the fourth quarter of 2018. ARR is anticipated to hit $170 million by the end of this year. The company’s higher level of investments on research & development is expected to continue, as it focuses on expanding offerings globally.

Moreover, adoption of ASC 606 is anticipated to negatively impact revenues in 2018. The company also expects cost of revenues and operating expense to be slightly lower in the year owing to adoption of the accounting standard.

The Zacks Consensus Estimate for revenues in the quarter under review is pegged at $36 million, up 29.8% year over year. While the Zacks Consensus Estimate for earnings is pegged at a loss of 8 cents per share.

Factors to Consider

Castlight’s software platform that assists organizations in gaining control over their health care costs is witnessing rapid adoption. This was evident from its top-line growth. Moreover, the company expects renewals to boost annualized recurring revenues (“ARR”).

The Zacks Consensus Estimate for Professional Services segment revenues is around $2.9 million while that for Subscription revenues is about $33.1 million.

The company’s strategic acquisition of Jiff has strengthened its product portfolio. Cross-selling of products is also expanding customer base.

Moreover, partnerships with the likes of Livongo, Big Health, Hinge Health, Retrofit and Kurbo are likely to help the company rapidly penetrate a number of health markets. Additionally, integration of Castlight's comprehensive health navigation platform with Washington Health Alliance will expand customer base.

We believe all these factors are likely to aid the company’s first-quarter results.

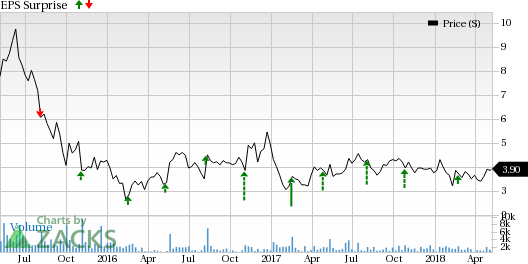

Castlight Health, inc. Price and EPS Surprise

Castlight Health, inc. Price and EPS Surprise | Castlight Health, inc. Quote

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or 5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Castlight has a Zacks Rank #3 and an Earnings ESP of 0.00%.

Stocks With Favorable Combination

Here are few companies which, as per our model, have the right combination of elements to post an earnings beat this quarter:

Yelp Inc. YELP has an Earnings ESP of +18.45% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

HubSpot, Inc. HUBS has an Earnings ESP of +5.60% and a Zacks Rank of 3.

Roku, Inc. ROKU has an Earnings ESP of +14.56% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yelp Inc. (YELP) : Free Stock Analysis Report

HubSpot, Inc. (HUBS) : Free Stock Analysis Report

Castlight Health, inc. (CSLT) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

To read this article on Zacks.com click here.