What's in Store for Federal Realty (FRT) in Q3 Earnings?

Federal Realty Investment Trust FRT is set to report third-quarter 2018 results after the market closes on Oct 31. Both its revenues and funds from operations (FFO) are anticipated to reflect year-over-year growth.

In the last reported quarter, this retail real estate investment trust (REIT) delivered a positive surprise of 1.31% with respect to FFO per share. Results indicate solid leasing activity leading to healthy occupancy at its properties.

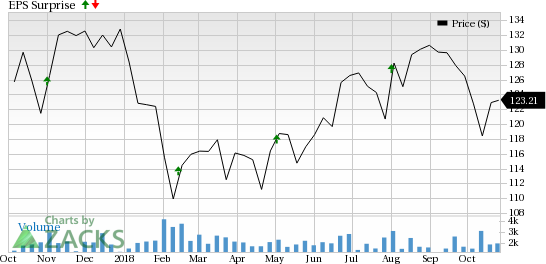

The company has a decent surprise history. In the trailing four quarters, it surpassed estimates in thrice and came in line in the other, with an average positive surprise of 1.17%. The graph below depicts the surprise history of the company:

Federal Realty Investment Trust Price and EPS Surprise

Federal Realty Investment Trust Price and EPS Surprise | Federal Realty Investment Trust Quote

Let’s see how things have shaped up for this announcement.

Factors to Consider

Amid fast-evolving retail environment, Federal Realty is making strategic efforts to reposition, redevelop and re-merchandise its portfolio. Moreover, the company is diversifying its portfolio with mixed-use properties. The concerted efforts are likely to help it achieve bottom-line growth in the to-be-reported quarter.

In addition, recovering economy, low unemployment level and rising incomes from tax cuts are likely to spur demand for retail goods. Further, high consumer sentiment, upbeat consumer sales and improving net absorption are likely to aid occupancy levels.

Amid these, the Zacks Consensus Estimate for third-quarter revenues is pegged at $228.5 million, indicating an improvement of 4.9% from the prior-year quarter. Total rental income is projected to be $225 million, up 6.1% year over year.

Nonetheless, though upbeat consumer confidence and an improving economy have infused optimism into the retail market, mall traffic continues to suffer amid rapid shift in customers’ shopping preferences and patterns with online purchases growing by leaps and bounds. These have made retailers reconsider their footprint and eventually opt for store closures.

Furthermore, retailers unable to cope with competition are filing bankruptcies. This has emerged as a pressing concern for retail REITs like Federal Realty, as the trend is curtailing demand for the retail real estate space considerably. Such an environment has also led to tenants demanding substantial lease concessions but mall landlords are finding these unjustified.

Also, Federal Realty’s activities during the quarter were insufficient to secure adequate analyst confidence. Consequently, the consensus estimate for third-quarter FFO per share remained stable at $1.55 in a month’s time. However, it indicates year-over-year rise of 3.3%.

Earnings Whispers

Our proven model does not conclusively show that Federal Realty is likely to beat earnings this season. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. However, that is not the case here as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Federal Realty is 0.00%.

Zacks Rank: Federal Realty’s Zacks Rank #3 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of a positive surprise.

Stocks That Warrant a Look

Here are a few other stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

UDR Inc. UDR, scheduled to release earnings on Oct 29, has an Earnings ESP of +0.68% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Welltower Inc. WELL, slated to release third-quarter results on Oct 30, has an Earnings ESP of +2.04% and a Zacks Rank of 3.

Public Storage PSA, set to report its quarterly numbers on Oct 30, has an Earnings ESP of +1.91% and a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

Public Storage (PSA) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.