What's in Store for Goodyear (GT) This Earnings Season?

The Goodyear Tire & Rubber Company GT is expected to report third-quarter 2018 earnings on Oct 26, before the market opens. In the last reported quarter, this tire manufacturer witnessed a positive surprise of 10.7%. The company surpassed estimates in all of the trailing four quarters, with an average beat of 15.2%.

Over the past six months, shares of Goodyear have underperformed the industry it belongs to. The stock has lost 25% compared with 22.6% decline recorded by the industry.

Let’s see, how things are shaping up for this announcement.

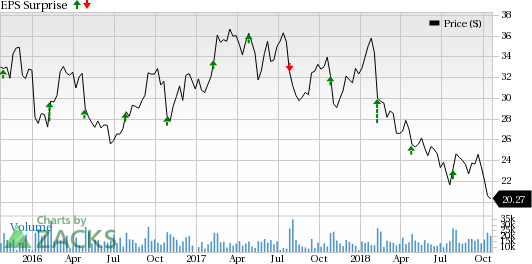

The Goodyear Tire & Rubber Company Price and EPS Surprise

The Goodyear Tire & Rubber Company Price and EPS Surprise | The Goodyear Tire & Rubber Company Quote

Factors to Consider

Goodyear is developing and launching products, enhanced with latest technologies. Based on innovative product launches, the company anticipates achieving segmental operating income of $2-$2.4 billion in 2020.

In second-quarter 2018, Goodyear witnessed an increase in global shipments of more than 4% year over year. The company anticipates doubling production to $6 million units by 2019. It was successful in recovering its share in 17-inch and bigger rim size markets in the United States and Europe. The improving industry in the United States and Europe, along with rising shares, will drive volume and mix growth. This is likely to have positive influence on the soon-to-be-released results.

However, competitive environment, increased raw-material costs and a drop in worldwide sales volume are a few concerns for Goodyear. In fact, the company reduced its segmental operating income projection for the second half of 2018 due to $70-million headwind related to softening market condition in China, $130 million rise in raw material costs and unfavorable foreign currency movement of $60 million.

Earnings Whisper

Our proven model does not conclusively show that Goodyear is likely to beat on earnings this quarter. This is because, a stock needs to have both a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as you will see below.

Earnings ESP: Goodyear has an Earnings ESP of -3.95% as the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 73 cents and 76 cents, respectively. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Goodyear currently carries a Zacks Rank 3. Further, this combined with its Earnings ESP makes the surprise prediction difficult.

Note that we caution against Rank #4 and 5 (Sell-rated) stocks going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are a few auto stocks worth considering, comprising the right combination of elements to deliver an earnings beat this time around:

Cummins Inc. CMI has an Earnings ESP of +1.46% and a Zacks Rank of 3. The company will report third-quarter 2018 financial figures on Oct 30.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Fox Factory Holding Corp. FOXF has an Earnings ESP of +2.77% and a Zacks Rank #3. The company’s third-quarter 2018 financial results are expected to be released on Nov 7.

Meritor, Inc. MTOR has an Earnings ESP of +2.36% and is a Zacks #3 Ranked player. The company’s third-quarter 2018 financial numbers are expected to be announced on Nov 14.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fox Factory Holding Corp. (FOXF) : Free Stock Analysis Report

Meritor, Inc. (MTOR) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research