Here's Why a Hold Strategy Is Apt for Verisk (VRSK) Stock Now

A prudent investment decision involves buying stocks that have solid prospects and selling those that carry risks. At times, it is rational to hold certain stocks that have enough potential but are weighed down by tough market conditions.

Here we discuss about Verisk Analytics, Inc. VRSK, a company that has an expected long-term earnings per share growth rate of 12.6% despite. Moreover, its earnings are expected to register 27.7% in 2018.

The company’s price performance over the past year looks impressive. Share of Verisk have gained 33.7%, outperforming the industry’s and S&P 500’s gain of 28.8% and 14.1%, respectively.

We believe the stock has the potential to exceed expectations moving ahead. The reasons behind our optimism include the company’s solid organic growth and benefits from strategic acquisitions and technology utilizations.

Holistic Growth Model

Verisk’s long-term organic growth is supported by its growth model. In fact, Verisk’s continuous organic revenue growth can be attributed to increasing new customers for existing solutions, cross-sale of its existing solutions to existing customers and sale of new solutions.

Notably, Verisk’s recorded an average organic revenue growth of about 8% over the past 10 years. In 2017, total revenues grew 5.3% on an organic constant-currency basis. In first-quarter 2018, total revenues were up 7% on an organic constant-currency basis.

The company’s operation in a large and diverse addressable market with low customer concentration helps mitigate operational risks. With high barriers to entry in the industry, Verisk also enjoys a dominant position.

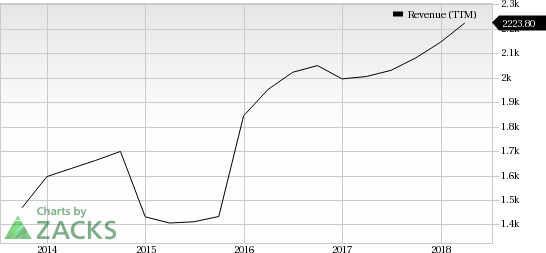

Verisk Analytics, Inc. Revenue (TTM)

Verisk Analytics, Inc. Revenue (TTM) | Verisk Analytics, Inc. Quote

Strategic Acquisitions

Verisk’s long-term business strategy includes growth through acquisitions. The company has been continuously acquiring and investing in companies globally to expand its data and analytics capabilities across industries.

From 2015 to 2017, the company completed 21 acquisitions. So far this year, Verisk has acquired two companies — Business Insight Limited on Feb 21 and Marketview Limited on Jan 5. Both these buyouts will help Verisk in its predictive analytics and consumer spending analytics decision making.

Technological Prowess

Verisk’s efforts to stay technologically updated to meet varying customer and client demands are impressive. In fact, technical prowess for analytics and Big Data gives the company an unrivalled edge over its competitors.

Advanced technologies such as the latest remote sensing and machine learning technologies along with cloud computing are the key catalysts behind the company’s business. A majority of the technologies used by Verisk is developed, maintained and supported by almost 20% of its employees.

Zacks Rank & Key Picks

Currently, Verisk has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader Business Services sector include Waste Connections WCN, Advanced Disposal Services ADSW and Stericycle SRCL. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term expected EPS (three to five years) growth rate for Waste Connections, Advanced Disposal Services and Stericycle is 13.3%, 15.5% and 9.6%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Stericycle, Inc. (SRCL) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

Advanced Disposal Services Inc. (ADSW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research