Here's Why j2 Global (JCOM) Stock is a Strong Buy Right Now

On Aug 25, 2018, j2 Global JCOM was upgraded to Zacks Rank #1 (Strong Buy). The upgrade reflects positive earnings estimate revisions as well as solid top-line growth.

Moreover, the Zacks Consensus Estimate for third-quarter 2018 earnings increased 2% to $1.5 per share over the last 30 days. For 2018, the consensus estimate increased 2.6% to $6.23 per share over the same time frame.

Notably, j2 Global beat the Zacks Consensus Estimate for earnings in two out of the trailing four quarters, with an average beat of 1.2%. Further, the company has a long-term expected EPS growth rate of 8%.

Notably, j2 Global reported impressive second-quarter 2018 results. Adjusted earnings beat the Zacks Consensus Estimate by 8 cents and increased 12.8% from the year-ago quarter to $1.50 per share. Revenues came in at $287.9 million, up 5.8% year over year.

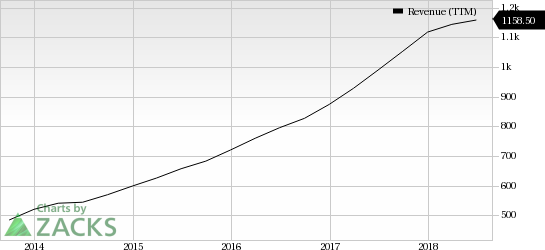

j2 Global, Inc. Revenue (TTM) | j2 Global, Inc. Quote

Let’s Take a Look at the Key Driving Factors

j2 Global is increasingly focusing on its performance-based marketing and subscription segments to drive revenues of Digital Media business. Per management, revenues from both the segments will continue to increase going forward driving the top line and offsetting the decline in the digital advertisement segment.

The ongoing shit in cost per thousand (CPM) market and increasing demand for ROI based solutions is setting j2 Global apart with its increased focus on performance-based marketing.

Notably, in the last reported quarter, Digital Media revenues were $137.6 million, up 7.1% year over year and total subscription revenues increased 4.7% year over year to $150.1 million.

Moreover, the company continues to benefit from its acquisition of Ookla.

A leading provider of mobile and broadband testing applications, Ookla, provides in depth analysis of Internet performance and accessibility, helping the company to deliver quality services.

Moreover, a growing numbers of users are using Ookla’s platform to check speed. Notably, in the last reported quarter, 10 million global tests per day were performed across all Ookla’s platforms.

We believe that j2 Global’s string of acquisitions will help it expand customer base, provide access to new markets and widen its product lineup. Moreover, increasing focus on performance-based marketing and subscription segment are expected to drive top-line growth going forward.

Other Stocks to Consider

Some other top-ranked stocks in the broader computer and technology sector are AT&T T, Paycom Software PAYC and Five9 FIVN. All the stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for AT&T, Paycom and Five9 is 3.6%, 24.8% and 20%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

j2 Global, Inc. (JCOM) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research