Here's Why MannKind Corporation Is Sinking

What happened

In response to reporting third-quarter results, shares of MannKind Corporation (NASDAQ: MNKD), a commercial-stage biopharma focused on inhaled insulin, fell as much as 14% in early morning trading on Wednesday. Shares have since recovered and are down about 9% as of 11:45 a.m. EST.

So what

The big news from the quarter was that MannKind successfully secured a labeling update for Afrezza.

Beyond that tidbit, here's a review of the headline numbers from the period:

Net revenue was $2 million. That number included 246% year-over-year growth in Afrezza sales, albeit from a very tiny base. However, Wall Street was expecting $3.9 million in total revenue, so this figure significantly missed the mark.

As of quarter end, the amount of Afrezza shipped to the company's disruption channels was $3 million. That was an increase of $0.4 million sequentially.

Net loss for the period was $32.9 million, or $0.31 per share. That was also much worse than the $0.20 loss that market watchers were projecting.

Quarterly cash burn was $23.3 million.

Cash balance at quarter end was $20.1 million. However, this figure does not include the $57.7 million in proceeds from the company's recently completed common stock offering.

What's more, on the company's call with investors, CEO Michael Castagna stated that sales in the second half of 2017 would come in at the lower end of its guidance range.

Given lower-than-hoped-for sales and guidance, it isn't hard to figure out why shares are falling.

Image source: Getty Images.

Now what

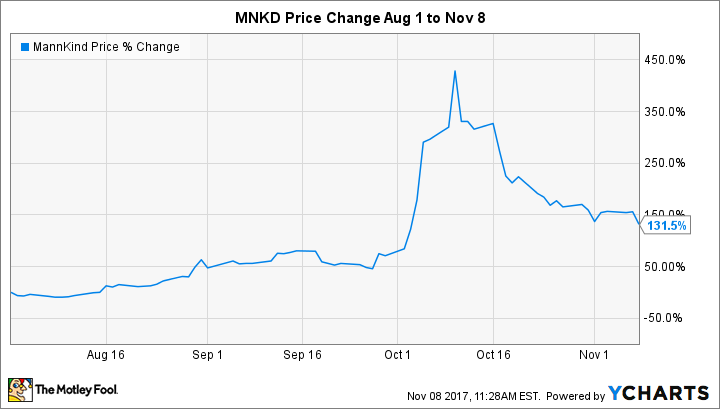

MannKind's bulls have had to endure an insane amount of volatility over the last few months. Shares were parabolic soon after the label update was announced -- which was likely caused by a short squeeze -- and then soon came crashing back to earth.

The good news is that the big jump allowed MannKind to significantly enhance its financial position. Castagna provided investors with a nice summary of the progress that has been made since he took over the top chair in late May:

On May 30, we had roughly $19 million in cash, a $10 million interest payment due in 45 days, $50 million of mandatory principal payments in 2018, a significant warrant overhang with restrictions that prevented us from doing many parts of our recapitalization, approximately 250 scripts a week, a U.S.-only focused business with no CFO or CCO, and a stock price hovering around $1.50.

Today, we have over $60 million in cash, only $20 million in payments due in 2018, no warrants restricting our recapitalization process; a world-class CFO and new CCO who replaced me; a new label under which we can effectively market our product; we've filed in Brazil and are in late-days discussions with other ex-U.S. distribution relationships; and we're hovering a little over 450 scripts a week, or an increase of 50% over the last five months.

Overall, MannKind is in a much better position today than it has been in years. However, the company's future is still completely dependent on an enormous uptick in Afrezza sales. Will the labeling change be enough to finally convince patients and providers to give Afrezza a try? That question is still very much in the air.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Brian Feroldi has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.