Here's Why You Must Buy Altra Industrial Motion (AIMC) Stock

Industrial Products is currently one of the favored sectors — occupying the sixth position — among the 16 Zacks sectors. It yielded 9.1% return in the past year.

It's worth noting here that the sector's earnings are predicted to increase 24.3% in 2018 on revenue growth of 9.5%. Of many indicators, few supporting the sector's growth are discussed below:

Prospering global economy, as well as advancing U.S. economy — predicted to grow 2.9% in 2018 by the International Monetary Fund — supports growth of the sector. Also, a healthy demand for U.S.-made machinery, expanding manufacturing sector and healthy job market is a boon. Industrial production is also growing impressively — a 4.2% growth has been recorded in July.

Investors interested in gaining exposure in the sector may choose stocks that have Zacks Rank #1 (Strong Buy) or #2 (Buy). Of many investment-friendly options, we believe that adding Altra Industrial Motion Corp. AIMC to the portfolio will be a smart choice. The stock currently sports a Zacks Rank #1 and has a favorable VGM Score of A.

Let's delve deeper and discuss why Altra Industrial Motion is a suitable investment option.

Bottom-Line Performance & Projections: Altra Industrial Motion's financial performance has remained better than expected in three out of the last four quarters. Average earnings surprise is a positive 4.01%. This average includes the impact of 7.58% earnings beat recorded in the second quarter of 2018. On a year-over-year basis, the company's bottom line in the second quarter increased 24.6% on the back of sales and margin improvement.

For 2018, Altra Industrial Motion anticipates gaining from solid organic sales growth opportunities, strengthening industrial economy, and business combination with Fortive Corporation's FTV Automation and Specialty business. It increased its earnings per share (non-GAAP) guidance from $2.36-$2.49 expected earlier to $2.45-$2.55.

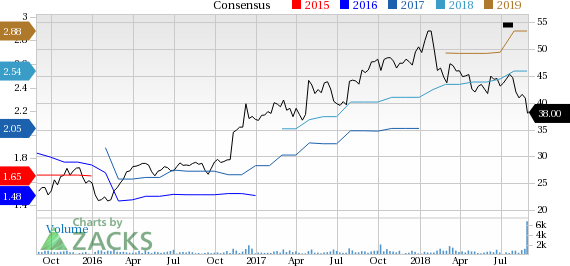

Driven by solid performance and impressive outlook, earnings estimates on the company have been increased in the past 60 days. Currently, the Zack Consensus Estimate for earnings is pegged at $2.54 for 2018 and $2.88 for 2019, reflecting growth of 2.8%, and 2.5% from the respective 60-day-ago tallies.

Altra Industrial Motion Corp. Price and Consensus

Altra Industrial Motion Corp. Price and Consensus | Altra Industrial Motion Corp. Quote

Solid Top Line: In the second quarter of 2018, Altra Industrial Motion's top-line growth of 6.3% compared with the last-reported quarter was driven by organic sales growth of 2.9% and forex gains of 3.3%. Also, the company recorded sales beat of 0.2%. Performance was healthy in the distribution, material handling, energy, metals market and mining end markets. For the Couplings Clutches & Brakes segment, revenues increased 10.6% year over year while grew 4.9% for the Gearing segment.

For 2018, the company has raised its revenue guidance to $920-$935 million from the earlier forecast of $910-$930 million.

In the past 60 days, the Zacks Consensus Estimate for revenues on the stock is pegged at $934.6 million for 2018 and $972.4 million for 2019, reflecting year-over-year growth of 6.6% and 4%, respectively.

Dividends & Acquisitions: Altra Industrial Motion is an ardent believer in rewarding shareholders handsomely, especially through dividend payments. In the first half of 2018, the company used $10 million cash for distributing dividends to shareholders. It's worth mentioning here that the company's dividend payments grew 28% (CAGR) from 2012 till 2017. We believe that net income growth in the quarters ahead will enable it to keep rewarding its shareholders with dividends.

Another interesting aspect about Altra Industrial Motion is its acquisitive nature.

Over time, the company has solidified its product portfolio and leveraged business opportunities through the addition of assets. Here, the buyout of Stromag — known for its tailored-engineered solution for customers in various markets — in December 2016 is worth mentioning. Stromag's product portfolio includes clutches and brakes, flexible couplings, limit switches and friction discs. Also, the company's business combination with Fortive's Automation and Specialty business will create a global leader in motion control, and power transmission.

Debt Profile: Altra Industrial Motion's long-term debt at the end of the first half of 2018 was $260 million, reflecting 5.6% decline from the balance at the end of 2017. Likewise, its total debt/total equity declined from 69.6% at 2017-end to 63.3% at the end of the first half of 2018.

Moreover, the company's debt profile is better compared with the industry it belongs to. Its debt/equity is lowered as compared with 84.1% for the industry.

Initiatives: With a view to keep costs under control and align business operations with the current demand levels, Altra Industrial Motion is working on certain restructuring and cost-saving initiatives. Such strategies will help the company in boosting its margins.

Over the long term, the company intends to lower the number of its facilities by 20-30% and improve its supply chain worldwide.

Other Stocks to Consider

Two other top-ranked stocks in the industry are Colfax Corporation CFX and Barnes Group Inc. B. While Colfax sports a Zacks Rank #1, Barnes Group carries a Zacks Rank #2. You can see the complete list of today's Zacks #1 Rank stocks here.

In the last 60 days, earnings estimates for both the stocks have improved for the current and the next year. Also, average positive earnings surprise for the last four quarters was 7.91% for Colfax and 6.88% for Barnes Group.

Best Electric Car Stock? You'll Never Guess It.

Zacks Research has released a report that may shock many investors. One stock stands out as the best way to invest in the surge to electric cars. And it's not the one you may think!

Much like petroleum 150 years ago, lithium battery power is set to shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, revenues that were already at $31 billion in 2016 are expected to blast to over $67 billion by the end of 2022.

See Zacks Best EV Stock Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research