Here's Why Things Look Gloomy for Ambarella Stock

Ambarella (NASDAQ: AMBA) has burnt investors badly this year. The stock has lost a third of its value so far in 2018, and it looks like a turnaround isn't going to happen anytime soon. The video-processing chip specialist raised investors' hopes earlier this year when it released computer vision chips aimed at the automotive and security camera markets, but that bet seems far from paying off. The chipmaker has also failed to recover from its loss of GoPro business.

Let's take a closer look at what's going on with Ambarella.

Image Source: Getty Images.

The non-GoPro business hasn't taken off

GoPro used to be the biggest driver of Ambarella's sales, accounting for as much as 30% of its revenue at one time. Not surprisingly, Ambarella took a hit when GoPro ran into rough weather. Then the action camera specialist decided to shop elsewhere for chips, and ultimately ditched Ambarella.

The chipmaker said it would build its non-GoPro revenue base and diversify its business, but that strategy hasn't boosted revenue. Ambarella's Q2 revenue of $62.5 million was a 12.8% drop from the year-ago period, including an 8.3% decrease in non-GoPro revenue. Ambarella expects revenue from GoPro to be "immaterial" in the current quarter while overall revenue is expected to notch a year-over-year drop of more than 30%.

In its most recent conference call with analysts, Ambarella blamed the drones and the wearables markets (including non-GoPro action cameras) for the revenue decline, which makes it clear that its products aren't finding traction in these markets. This is a red flag for investors, as both of these markets have been growing at a rapid pace. Market research firm IDC estimates that worldwide drone spending is going to increase at an annual pace of nearly 30% for the next five years.

What's more alarming is that this is not a one-time weakness. The non-GoPro business has failed to make a substantial impact and offset the GoPro decline for the past three years.

Metric | FY 2016 | FY 2017 | FY 2018 | FY 2019 (estimate)* |

|---|---|---|---|---|

GoPro revenue (in millions) | $96 | $75 | $37 | Negligible |

Non-GoPro revenue (in millions) | $220 | $235 | $258 | $229 |

Total Revenue (in millions) | $316 | $310 | $295 | $229 |

Source: Ambarella's annual reports. FY 2019 ends in January 2019. *Numbers based on Ambarella's latest guidance.

Ambarella was originally expecting $258 million in non-GoPro revenue this year, but has been forced to scale back that expectation by 11% thanks to weak demand for its products and its failure to crack new markets.

The big red flag

Ambarella management said on its latest conference call that its sales decline will accelerate for the rest of the year. More specifically, non-GoPro revenue is expected to drop 20% in the current quarter, and the company's automotive business isn't expected to get better. According to George Laplante, executive vice president:

We believe the auto market will be below our previous growth expectations in the second half as delays in launching new customer and products will reduce our year-over-year growth expectations in this market.

Ambarella says that its computer vision chips are currently being evaluated by leading customers, but they have been in the evaluation phase since they were released in January. The chipmaker has been putting in a lot of effort, both on the product development front and the marketing front, to push sales of its products into both new and existing markets, but customers seem to be looking the other way.

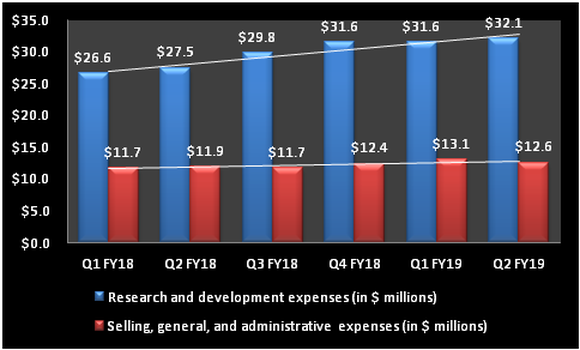

Data from Ambarella's quarterly reports, Chart by author.

So why is Ambarella struggling to find its footing in these markets that could have helped it make a comeback? There are two simple reasons behind its predicament.

First, Ambarella operates in a commoditized market. Sooner or later the company was bound to fall prey to competition from low-cost chipmakers out of China, which seem to be eating away at its traditional markets including drones and IP cameras. As a result, Ambarella's margins have been declining for more than a year as it has been forced to lower prices to compete against Chinese chipmakers.

AMBA Gross Profit Margin (TTM) data by YCharts

Second, Ambarella has been late to the computer vision market. Deep-pocketed rivals such as Intel and Qualcomm had already developed such chips for drones and cars before Ambarella joined the fray. These tech giants already have an established ecosystem of partners and customers testing their chips. Intel, for instance, had tied up with the likes of BMW, Alphabet's Waymo, Fiat Chrysler, and Audi, among others, even before Ambarella announced its computer vision chips.

What's more, Intel has already demonstrated that its automotive chips work in real-world conditions. Not surprisingly, Chipzilla has been able to score big deals in autonomous cars.

More downside ahead

Small chipmakers such as Ambarella can easily be crushed by tech giants. To gain access to markets such as self-driving cars, Ambarella could be forced to compromise on pricing and settle for lower margins. But even that doesn't guarantee success, because rivals have demonstrated considerable expertise in areas where Ambarella is just getting started.

Moreover, low-cost Chinese competition is yet another concern that's hurting Ambarella. So it isn't surprising to see that the company's earnings are expected to drop in the coming years, giving investors a clear sign that they should stay away from Ambarella stock.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Ambarella, and GoPro. The Motley Fool owns shares of Qualcomm. The Motley Fool recommends BMW. The Motley Fool has a disclosure policy.