Can AppFolio (APPF) Pull Off a Surprise in Q4 Earnings?

Appfolio Inc. APPF is slated to report fourth-quarter 2017 results after the closing bell on Feb 26.

Last quarter, the company delivered earnings of 13 cents, which were well ahead of the Zacks Consensus Estimate of 7 cents. It had reported in-line results in the year-ago quarter. Notably, the company has a positive earnings surprise track record. It has beaten estimates in the trailing four quarters, recording an average positive surprise of 238.1%.

Revenues surged almost 34.6% to $37.9 million. The figure was also better than the Zacks Consensus Estimate of $36 million.

The company also raised 2017 guidance following the impressive third-quarter results. The company now projects revenues in the range of $140-$141 million, up from previous guidance range of $138-$139 million. The Zacks Consensus Estimate for revenues is pegged at $141.8 million.

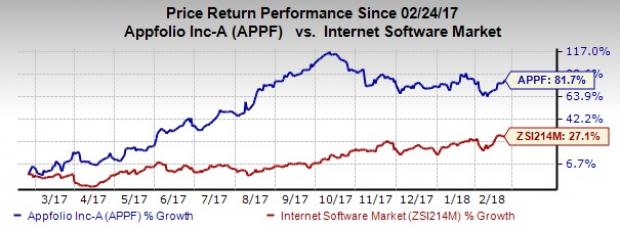

Notably, Appfolio shares have gained 81.7% year over year, substantially outperforming the 27.1% rally of the industry it belongs to.

Let's see how things are shaping up for this announcement.

Factors Influencing Q4 results

AppFolio’s constant focus on product and technology related innovations are key catalysts for growth. The company continuously upgrades product suite based on customer feedback, making the offerings more consumer friendly.

The company also announced that it is looking forward to its integration with Amazon’s AMZN voice service, Alexa. This feature will allow tenants to pay rents or submit other requests using voice commands through AppFolio’s platform. We believe the company’s collaboration with Amazon along with the expansion of its offerings will boost the top line going forward.

Notably, the company upgraded its product suite during the third quarter with enhancements including the likes of AppFolio Renters Insurance, a new Value+ Service, and same day ACH, an addition to the existing Electronic Payments Value+ Platform.

These advancements are anticipated to increase the customer base of the company, which comprised 11,258 property managers and around 9,000 legal customers at the end of the third quarter.

However, intensifying competition in the cloud based business software solutions space remains a concern.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The sell-rated stocks (Zacks Rank #4 or 5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

AppFolio has a Zacks Rank #4 (Sell) and an Earnings ESP of +44.44%.

Stocks to Consider

Here are some companies you may also want to consider as our model shows that these have the right combination of elements to beat on earnings:

Workday, Inc. WDAY has an Earnings ESP of +7.24% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Analog Devices, Inc. ADI has an Earnings ESP of +0.57% and a Zacks Rank #3.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp. and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research