New Apple: Up 20%, Epic Buybacks, More Cash

In April, Apple (AAPL) announced plans to spend $60 billion by the end of 2015 to buy back shares. It didn’t wait long to make a big dent in that spending plan. In the fiscal third quarter ended June 29, Apple spent $16 billion on repurchases. According to FactSet that’s the largest one-quarter outlay for repurchases since 2000, outpacing the $14.6 billion International Business Machines (IBM) spent in the second quarter of 2007.

Timing is key with stock buybacks; a basic goal being to buy back shares when they are cheap. IBM, which has been a consistent repurchaser for years -- reducing its shares outstanding by more than a third over the past 10 years -- nonetheless ramped up its repurchases from the second quarter of ’07 into September of ’08; hindsight is 20/20 but that turned out to be an expensive time to be buying back shares.

Apple’s massive fiscal third quarter repurchase action looks like it may well be a buy-low move. The stock opened the quarter at $442 per share, hit a quarter low of $392 and ended at $409, as seen in a stock chart.

NASDAQ:AAPL data by YCharts

It will be interesting just to see what the fiscal fourth quarter activity comes in at. Given that Apple’s share price has rallied about 20% since July 1, compared to 5.5% for the S&P 500 index. That’s not to say that Apple has risen into pricey territory. And it’s not as if the cash coffers are being materially reduced by the investment in shares; cash and short term holdings still grew nearly 9% in the fiscal third quarter.

(When you throw in long-term marketable securities, which were $104 billion at June 29, Apple is carrying $146.6 billion of liquid assets, versus $121.2 billion last September 29; not bad considering the buybacks and dividend payouts.)

AAPL Operating PE Ratio (Annual) data by YCharts

Tim Cook’s frenemy -- and new Apple shareholder -- Carl Icahn is agitating for increasing the buyback plan beyond the $60 billion by the end of 2015. But there’s still a hefty $44 billion left on the current repurchase plan (at least as of the end of the fiscal third quarter.) That’s more than the $40 billion open-ended repurchase plan (i.e., no time line) Microsoft (MSFT) announced last week.

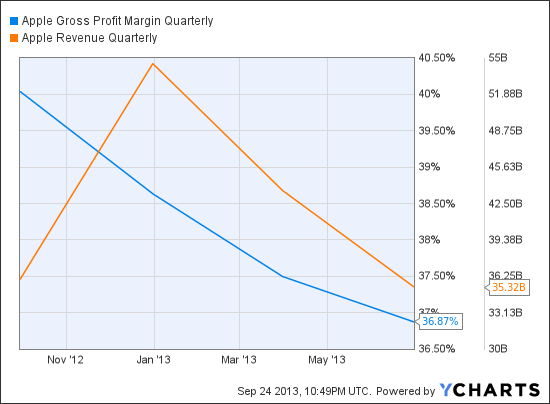

And if you’re Cook, you just might be feeling less pressure to deliver repurchases above and beyond that already high bar. After strong opening weekend sales for the iPhone 5s and 5c, Apple filed notice with the SEC that it expects its quarterly revenue to come in near the high end of its $34 billion-to-$37 billion estimate, and for gross profit margins to be near the high end of the 36%-37% range.

A 37% gross profit margin is still well below the March 2012 peak above 47%, but it would mark the first upward tick in 18 months.

AAPL Gross Profit Margin Quarterly data by YCharts

And Cook did say way back in April that it would be the fourth quarter of this year and early next when we would start seeing “amazing new hardware, software, and services” rolling out of Apple’s pipeline. If that materializes -- and the stock responds -- Icahn might quiet down on the repurchases.

Carla Fried, a senior contributing editor at ycharts.com, has covered investing for more than 25 years. Her work appears in The New York Times, Bloomberg.com and Money Magazine. She can be reached at editor@ycharts.com. Read the RIABiz profile of YCharts. You can also request a demonstration of YCharts Platinum.

More From YCharts